Life, Love and the Pursuit of Travel Hacking Part #1 (My fave: credit cards/sign up bonus)

***TIME SENSITIVE/Last chance ~ Chase Sapphire Reserve 100K Bonus IS NO LONGER AVAILABLE***

I have talked to a number of people about my money saving post (click here for that post) and have had so many questions asked about my fave travel hack: credit cards that I figured that should do an in depth post. And since there is a very time sensitive promotion that is about to expire, the time is perfect to jump into this topic.

Oh a couple of background things: So what’s travel hacking mean to me? It’s how one is able to travel cheaply or for free (or close to free with just a small amount for taxes and fees) but also how to travel better (upgraded cabin on a flight or upgraded hotel room). And so why are credit cards my favorite travel hack? Because they really make your money work for you with the benefits that they offer and the large sign up offers. (Yes couchsurfing may offer free accommodations but I attract enough weirdness without adding that into my life.)

Okay I am concentrating this post Chase’s Sapphire Reserve credit card and American Express (AMEX) Platinum card because 1. Chase announced today that it will be reducing the sign up bonus from 100,000 Ultimate Reward (UR) Points to 50,000 points on January 12 for online applications (or in branch before March 12) and 2. These cards with their sign up bonus and benefits really illustrate my points about travel hacking. (Note: these two cards are for those who have really good/excellent credit)

So let’s start with the most obvious thing that everyone will notice when they see either one of these cards ~ the annual fee. Take a deep breathe ~ yes you did read that right ~ $450 per year is no small amount of money but let’s break it down and see the cost/benefit analysis or what are you paying and what are you receiving for said dollars. Another way to think about this is putting a dollar amount to what comes with the card and does that earn your annual fee back or even better make you more money?

SIGN UP BONUSES:

AMEX: 40K bonus points after you spend $3,000 on purchases (in the first 3 months from account opening) Note infrequently happens but there have been 100K (rarely made public) -150K (these tend to be targeted) bonus offers. Redeem points directly through AMEX Membership Rewards®. Or you can transfer points to certain airline and hotel loyalty programs.

Chase: 100K bonus points after you spend $4,000 on purchases (in the first 3 months from account opening) Note deadlines above! While you do receive a 50% bonus when you redeem your points for travel i.e. airfares or hotels through Chase Ultimate Rewards portal (for example, a 100K points are worth $1500), but I would personally never go this route. I know that many will say that have been using third parties for travel for years and never had a problem but if an issue arises, the hotel or airline CANNOT fix the problem and you have to go back to the portal or the OTA. I have seen too many instances when things go wrong this way so I prefer to do a 1:1 point transfer to certain airline and hotel loyalty programs and think that the sign up bonus is worth at least $2000 this way.

BOTH CARDS ~ SAME BENEFITS

- Up to $100 application fee credit for Global Entry or TSA Pre✓® (I love having Global Entry!)

- No foreign transaction fees

- Complimentary Priority Pass™ Select membership ~ access to 900+ airport lounges worldwide with (AMEX also includes access to Centurion lounges and Delta Sky lounges when flying Delta). This perk is awesome as you normally have to be flying first or business class or have status with an airline to get into a lounge or pay for a day pass!

SIMILAR BENEFITS on both cards with some important distinctions

AMEX

- $200 Annual Airline Fee Credit. Important to note this benefit is per calendar year but only valid for one airline (you must designate this prior) and is for fees only

- 5X points on flights booked directly with airlines or AMEX Travel, 2X points on eligible purchases on AMEX Travel and 1 point per dollar spent on all other purchases

CHASE:

- $300 Annual Travel Credit as reimbursement for ALL travel purchases such as airfare and hotels! Again this is benefit is per calendar year! Besides the sign up bonus ~ this is the distinguishing benefit for me!

- 3X points on travel and dining at restaurants worldwide & 1 point per dollar spent on all other purchases.

AMEX additional benefits:

- Hilton HHonors™ Gold Status enrollment and benefits

- Starwood Preferred Guest Gold Status enrollment and benefits

- THE HOTEL COLLECTION: Get a $75 hotel credit on qualifying charges, plus get 2X points per eligible dollar spent when you book The Hotel Collection at americanexpress.com/hc.

- My absolute favorite perk: access to AMEX centurion airport lounged

Ok so now we have the major benefits that most people would benefit, let’s examine them in more detail. So let’s start with the Chase card and say you use your card to pay for a international getaway ~ the card automatically will reimburse you the money you paid on travel so those flight and hotel costs – $300. And you used a lounge? (Note: one downside is that major US airlines like Delta, United and American don’t participate in Priority Pass). Whenever I looked at the info at the reception desk at these lounges, day passes can range from $25-$50 so we’ll estimate the savings to be $25 here. And it appears that your travel companions also have free access. And also not having foreign transaction fee saved you $90 on the $3,000 you spent overseas. And you also signed up and used Global Entry?! Not having to wait in that crazy queue ~ priceless. But really here this example is not that far fetched for a lot of people and shows how a card even with a large annual fee can be beneficial for you. And remember when I told you that the benefits for the $300 travel was per calendar year ~ if you racked up $300 in travel purchases in 2018 before your annual fee then you would have $600 in travel reimbursement alone! (Chase has since modified this benefit to your award year so you can no longer double dip).

Some of these benefits are similar for the AMEX card with Global Entry and PriorityPass (though a guest will cost you $27 billed to your card) access but the airline fee benefit works differently as you must choose one airline annually and only certain fees are rebated. For me, I have used this benefit when booking/changing frequent flier miles awards for the fees assessed. And it was very nice that the benefit was per calendar year because I had $375 refunded during one annual fee cycle. I already had status with SPG but it was nice to have it automatically with Hilton.

So if you’ve been on the fence about the Sapphire Reserve, you need to act soon! But maybe neither of these cards will work even with their benefits and bonuses but another card will work better. Just look at the benefits and bonuses and go from there!

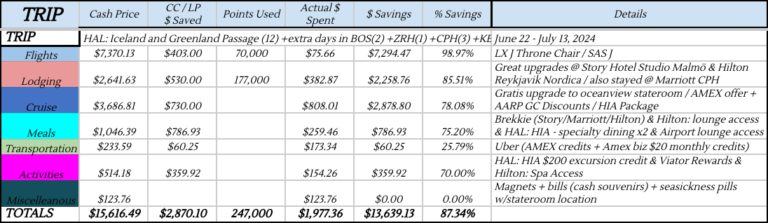

My next post on travel hacks will dive more in depth for how I used my miles/points to really show you the value of travel hacking!

Do you have either one of these cards and agree/disagree with me on the value? Or have other travel hack topics you would like me to cover in more detail?

Love that Reserve card from Chase 😁

It’s such a great travel card!