Card Review: Why I LOVE My Amex Hilton Aspire Card (& How I Have My High Annual Fee Card Pays For Itself)

FULL DISCLOSURE if you use one of my referrals link and get approved for a card, I will receive referral credit – the offers are the exact same as the public offers. There is no additional cost to you but by using my links, you help with the ever increasing costs for maintaining this site.

One of the big hurdles for people with travel hacking after they get on board with credit cards is wrapping your mind around annual fees. Trust me, I was once you and felt the same way but then realized that I was thinking of them in the same way that I thought on insufficient fund or late fees – things that needed to be avoided at all costs. I think of them differently now and they’re more akin to paying for Spotify Premium – I am paying for access. But not only do I now have the ability to earn points/miles, but every travel card I have has the potential to pay for itself – or in my case, I am profiting from holding the card. Let me show you with one of my favorite credit cards – and one that has a high annual fee how this works.

As always, DISCLAIMER for credit cards is that you should only consider getting these cards if 1. you are able to pay off your balances every month – if you pay interest, those rates are so high that they will negate ALL rewards and 2. if you are not spending more money than you would otherwise. (Some posts that might be helpful: refresher on credit cards / how to earn points with credit card’s sign up bonus / intro to travel hacking / 8 top tips for travel hacking). (FULL DISCLOSURE if you use the link, I will receive referral credit – the offers are the exact same as the public offers but using my links helps subsidize the ever increasing costs for maintaining this site)

The Amex Hilton Honors Aspire Credit Card is a premium co-branded hotel credit card designed for frequent travelers who prefer Hilton properties. It offers a luxury travel experience with top-tier benefits, valuable rewards, and premium perks.

Here’s a detailed breakdown of the card’s benefits

Welcome Bonus

- Typically, a high welcome offer (varies over time, often 150,000+ Hilton Honors Points after meeting spending requirements). Current offer until April 29, 2025 is 175,000 – see the other great deals on Amex Hilton cards

- Points can be redeemed for free Hilton stays, including luxury properties.

My Experience/Return on Investment (ROI)

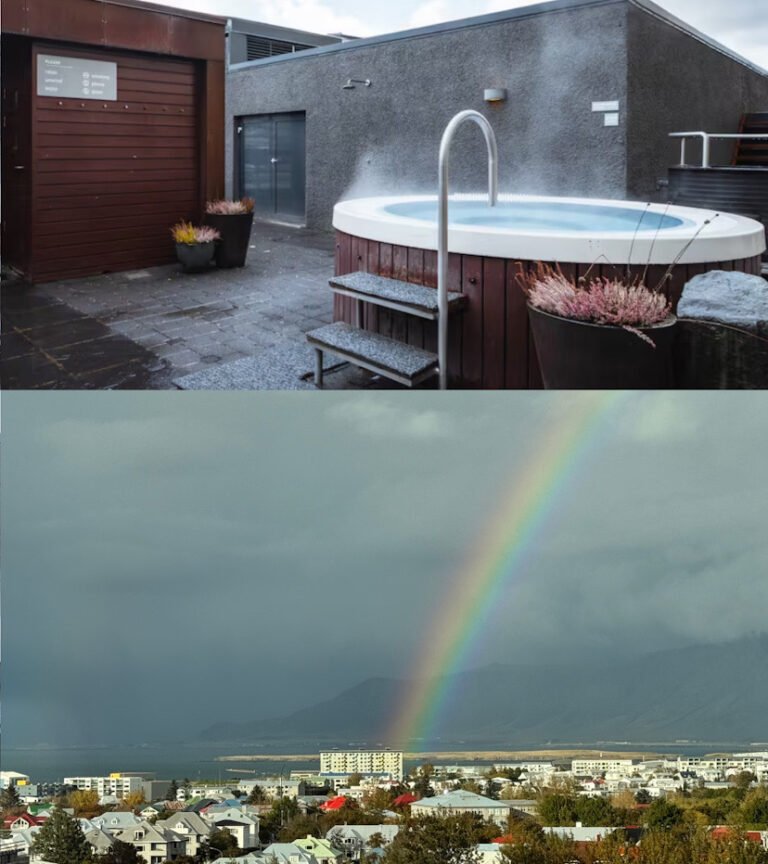

I received 150,000 HH points and some of those were used at the Hilton Reykjavik Nordica and some went towards my Cabo holiday – both helped me travel for better, cheaper and more often so great use of points in my book!

Hilton Honors Diamond Status

- Top-tier elite status in the Hilton Honors that automatically comes with the card for as long as you hold the card

- Benefits include:

- Room upgrades (including 1 bedroom suites, when available).

- Daily Food & Beverage Credit or Free Breakfast (at eligible hotels).

- Executive Lounge Access (where available).

- Bonus points (100% extra points on Hilton stays).

- Late checkout (when available).

- 48-hour Room Guarantee.

My Experience/ROI

While Hilton’s loyalty program is not as clearly defined and consistently awarded as Hyatt’s, I have found Hilton to be better with for status with upgrades than Marriott – I have always been acknowledged as Diamond upon check in and have received some really great upgrades. The executive lounges and breakfast (outside of the US) have been really good and big money savers.

Free Night Reward

- One Free Night Award each year (beginning in first year of holding the card and automatically upon card renewal).

- After spending $30,000 in a calendar year, you can earn a second FNR

- And a third award after spending $60,000 in a calendar year.

- Read all about one of the best credit card perks and the Hilton Free Night Reward here

My Experience/Return on Investment

I used my FNR from the first year of holding the card at the Waldorf Astoria Los Cabos Pedegral during a sold out spring break weekend when rooms were going for almost $3,000 per night! I used the second year’s reward at Zemi Beach House when the room was going for $1,500 per night and stayed both time at properties I would have never been able to afford cash prices for.

$400 Hilton Resort Credit

- Up to $400 in statement credits per year for eligible purchases at Hilton Resorts.

- Note that this is a bi-annual credit (Jan – June / July – Dec) and that it must be used at a designated resort property

- Can be used on room rates, dining, spa treatments, and other on-property expenses.

My Experience/ROI

I love that Amex will automatically credit for this benefit and I have been able to use the resort credit for a fancy dinner at El Farallon in Cabo, Mexico and also for multiple meals in Anguilla.

$200 Airline Fee Credit

- Up to $200 in statement credits per calendar year

- Note: this is $50 quarterly credit and is no longer restricted to incidentals nor one airline (which differs from the Amex Platinum cards)

My Experience/Return on Investment

One nice update to the card was that this benefit is now no longer tied to one airline so I have been able to use it with Air Canada one quarter, United another and American Airlines for others – also nice that this is automatically credited by Amex.

$189 CLEAR® Plus Credit

- Covers CLEAR Plus membership, which offers expedited airport security screening at select U.S. airports.

My Experience/ROI

Easy to add to pay for the membership – I love having both Clear and TSA Precheck as I absolutely loathe hating in line and dealing with airport security. The experience is always smoother when I can pair the two.

Hilton Honors Points on Purchases

- 14X Points on Hilton hotel stays.

- 7X Points on

- Flights booked directly with airlines or via amextravel.com.

- Car rentals booked directly with select companies.

- U.S. restaurants.

- 3X Points on all other eligible purchases.

My Experience/Return on Investment

I love that even on the items above that are rebated by Amex such Hilton resort charges and airline charges, I am still earning HH points!

No Foreign Transaction Fees (FTF)

- Ideal for international travelers—use the card abroad without extra fees.

My Experience/ROI

FTF are definitely something that you need to look into if you are traveling internationally – they quickly add up and having a card that doesn’t charge saves you money.

Travel and Purchase Protections

- Trip Cancellation & Interruption Insurance: Covers up to $10,000 per trip for prepaid, non-refundable travel expenses.

- Baggage Insurance Plan: Coverage for lost, damaged, or stolen baggage.

- Extended Warranty & Purchase Protection: For eligible purchases.

My Experience/Return on Investment

Knock on wood that I have not needed to use these…yet.

Access to Amex Offers

- Discounts and bonus points on shopping, dining, and travel.

My Experience/ROI

I love Amex Offers and there are often different ones for my Hilton cards that the charge cards so it has been nice to be able to save money here.

$100 Property Credit

- Up to $100 credit for 2 night minimum stays at Waldorf Astoria or Conrad Hotels & Resorts when booking using a specific Aspire rate code

My Experience/Return on Investment

Have not used

Complimentary National Car Rental Status

- Emerald Club Executive Status

My Experience/Return on Investment

Have not used

Bottom Line Review

Even with a steep $550 annual fee, the Amex Hilton Honors Aspire Credit Card continues to hold a place in my wallet with the outsized benefits for holding the card. The free night rewards alone more than make up for that fee and the rest are just icing on the cake.

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

I am so excited for this card

I got this card after getting the no annual fee one earlier this year – hoping to stay at the Cabo hotel you stayed at! Used your links – thanks!

Hi Luther! Oh I hope that you also love the Waldorf – there’s a few write ups about that property and my stay in case you hadn’t seen those. And thank you so much for using my links!!