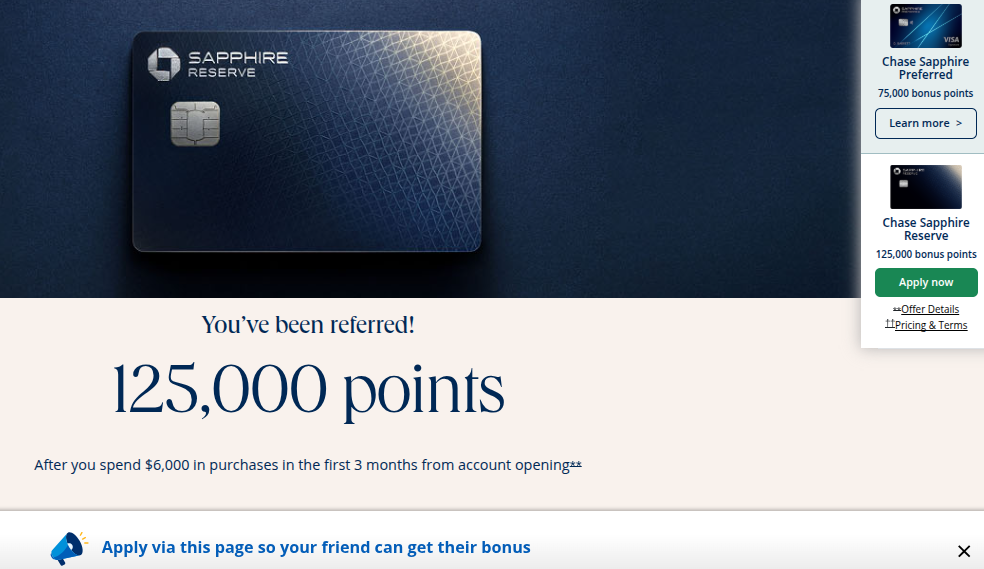

Revamped Chase Sapphire Reserve: Look at the Benefits and NEW 125,000 Points Sign Up Bonus!

Updated January 21, 2026

Originally Published August 21, 2025

The Chase Sapphire Reserve card(CSR) was completely overhauled in July and Chase combined that rollout with what it termed as their best ever offer on this card with a sign up bonus (SUB) of 100,000 points and $500 Chase TravelSM promo credit! Which has since expired as of 9 AM EDT on August 21, 2025

BUT one of the most interesting things happened when that offer expired was that Chase immediately started offering a sign up bonus of 125,000 points with a $6,000 spend requirement and many (including myself) would consider this to be the best ever offer for this card.

So let’s take a look at what this card offers and why it might make sense for you. Plus a bonus look at why flexible points are so important AKA what makes them valuable.

In case you don’t read my other posts on this subject, I must stress to please only consider if you can pay off the credit card IN FULL every month because no reward amount can justify interest charges! Curious about credit: read this.

To understand why I am so passionate about this hobby, I always like to go back to my definition of travel hacking/award travel: it’s simply traveling for cheaper, better and/or more often and credit cards are the NUMBER one way to be able to do this.

So why are credit cards my favorite travel hack? You put your everyday spend on a rewards credit card and earn points that you will be able to use for hotel rooms and/or flights for free or very low cost travel! When you start to maximize the spend with sign up bonuses (SUBs) for new cards, then you are really making your money work for you (read this for more info on SUBs and this for how to meet spending requirements)

What is the new Chase Sapphire Reserve offer?

After spending $6,000 within the first three months from account opening of your Chase Sapphire Reserve, you will receive 125,000 Chase Ultimate Reward points where the outsized value lies in the ability to transfer those to Chase travel partners (more on that in the what you can use the points for section).

Sapphire Reserve: What Has Changed + What Are The Benefits?

ANNUAL FEE

$795 ($245 from $550)

$195 for Authorized Users (from $75)

$300 Annual Travel Credit

Remains Unchanged

Auto applied as statement credits

Lounge Access

Remains Unchanged

Priority Pass + Sapphire Lounges (for you + 2 guests)

$500 credits with the Edit

New bi-annual benefit

Split as two $250 benefits

$120 application fee credit

Amount increased from $100 to fully cover Global Entry

For Global Entry, TSA PreCheck or Nexus

$300 Dining credits

New bi-annual benefit

Split as two $150 benefits for select restaurants

$300 DoorDash promos

Remains Unchanged

Monthly: $5 restaurant + 2x$10 grocery/retail orders promos

$250: Apple TV + Music

New benefit

Get complimentary Apple TV+ and Apple Music (thru 6/22/2027)

$120 Lyft credit + 5xpoints

Remains Unchanged

Monthly $10 in app credits + 5x total points on Lyft rides (thru 9/30/27)

$300 StubHub credits

New bi-annual benefit

Split as two $150 benefits for StubHub and viagogo purchases through 12/31/27. Activation required

$120 Peloton credit

Remains Unchanged

Monthly $10 statement credits toward Peloton memberships + 10xTotal points of Peloton equipement purchases

IHG Platinum Elite Status

New benefit – Complimentary

Second highest elite tier w/ comp upgrades, a points boost, reward night discounts + late checkout

Travel Benefits

Remains Unchanged

Earning Categories

Updated

Points Value/Redemption via Chase Travel

Eliminated 1.5 points value

Some important definitions/terms/helpful hints for the above benefits:

- Bi-annual = twice a year with first portion from January through June & second is from July to December

- The Edit: Collection of luxury hotels and resorts curated by Chase with stays being booked via Chase Travel to qualify

- Up to $250 in statement credits from January through June and again from July through December for prepaid bookings made with The Edit. Two-night minimum. Purchases that qualify will not earn points

- Enjoy complimentary benefits like a $100 property credit, daily breakfast for two, room upgrades (if available) and more with The Edit bookings

- Beautiful tip: $120 application fee credit towards Global Entry, TSA PreCheck or Nexus doesn’t have to be for you. For example, I already have Global Entry (that also includes TSA PreCheck) so I have gifted this benefit from various cards to my parents and friends!

- Dining Credits: bi-annual $150 for dining at restaurants that are part of our Sapphire Reserve Exclusive Tables – see list here

- DoorDash Membership is also complimentary with this card (value $120): Membership and DoorDash promos are through 12/31/2027

- IHG One Rewards Platinum Elite Status through 12/31/2027 (some status perks are subject to availability)

- Beautiful tip: IHG Platinum Elite Status can be matched to Hertz Gold Five Stars status

- Travel & Purchase Protection Benefits – here’s the benefits guide

- No foreign transaction fees (these can range from 1-3% which really adds up when you are traveling internationally)

- Trip Cancellation/Interruption Insurance, Baggage Delay Insurance, Trip Delay Reimbursement & Travel and Emergency Assistance Services,

- Auto Rental Collision Damage Waiver

- Purchase Protection & Extended Warranty Protection

- Earning Categories – new earning rates

- 8 points/$1 for travel booked through Chase

- 4 points/$1 for flights booked directly with airlines / hotels stays booked directly

- 3 points/$1 on dining

- 1 point/$1 on all other travel (old 3 points/$1)

- 1 point/$1 on all other purchases

- Redemption in Chase Travel portal: Instead of redeeming points are at a value of 1.5 cents – there is a new program called “Points Boost” in which cardholders can redeem points at a value of 2 cents/apiece on select flights and hotels – other bookings will be just 1 cent per point.

- Beautiful tip: transferring to Chase travel partners will typically be more lucrative plus you will not be booking via a portal/third party =)

Beautiful tip: Depending on the location and the activities that you will be doing, you may want to consider purchasing a standalone travel insurance policy since being injured or needing medical evacuation IS NOT covered and can be very costly. I personally have stand alone yearly travel and international medical policies.

Plus for big spenders – those spending more than $75,000/year, there are additional benefits

- IHG One Rewards Diamond Elite status: This is the highest IHG elite status tier, offering 100% bonus points on eligible purchases, dedicated Diamond support, and free breakfast at participating hotels.

- Southwest Airlines A-List status: Southwest A-List members receive priority boarding, one free checked bag, same-day standby, and more.

- $500 Southwest Airlines Chase Travel credit: Receive up to $500 credit for Southwest Airlines purchases made through Chase Travel.

- $250 credit for The Shops at Chase: Receive up to $250 credit for The Shops at Chase, a new online shopping experience where you can purchase items from top brands like Ray-Ban, TUMI, and more.

Sapphire Reserve: 2026 Updated Benefits

- More Flexible $500 Credit for stays with The Edit

- The existing $500 annual credit for prepaid stays at The Edit by Chase Travel properties no longer has rigid six-month windows

- Instead: You can receive up to $250 per qualifying stay (minimum 2 nights), whenever you book during the year up to the full $500/year.

- Purchases that qualify will not earn points

- New $250 Annual Hotel Credit

- Qualifying prepaid hotel stays (minimum 2 nights) booked via the Chase Travel portal at specific brands such as: IHG Hotels & Resorts / Montage Hotels & Resorts / Omni Hotels & Resorts / Virgin Hotels / Minor Hotels / Pan Pacific Hotels & Resorts / Pendry Hotels & Resorts

- Purchases that qualify will not earn points

Chase Sapphire Reserve Additional Exclusive Benefits!

The Chase Sapphire Reserve card is billed a premium card and offers exclusive benefits and has had some surprising

- Limited Time Offer: Get a FREE 5,000 point Aeroplan® Flight Reward Certificate (August 2025, read more about this limited time offer that has expired here – which I was able to successfully get!)

- First Look: Shrinking Season 3 with Apple TV: exclusive early access to the first two episodes of Apple TV’s Shrinking Season 3 (January 26, 2026 – read more about the first look here!)

- FIFA World Cup 26 Tickets Access Offer: FIFA has reserved a selection of FIFA World Cup 26™ tickets just for Chase Sapphire Visa cardmembers (February 10, 2026-February 24, 2026 – read more about the FIFA World Cup 26 tickets here

- Dinner on the Court @ Madison Square Garden and Chase Center (Feb. 23: New York, NY / Mar. 4: San Francisco, CA)

Why You Should Consider This Offer

How to decide if thisChase Sapphire Reserve makes sense for you? First thing first – yes the annual fee is $795 and that is a very big increase over the previous $550 annual fee. So look at it from a $ perspective: figure out which benefits you will be able to use along with their $ value to figure out how much of the annual fee will be offset. And remember that these benefits are really only valuable if you are saving money on goods/services that you would have already been buying =)

- Value $300-Travel Credit: Unbelievably easy to use as Chase has a generous definition for travel and credits your account automatically (ie spend $40 with Lyft or $5 on public transportation, there will be an offsetting Travel Credit $300/year posted same day)

- Value $100-Application Fee Credit: Towards Global Entry / TSA PreCheck or Nexus

- Value $300-Sapphire Reserve Exclusive Tables Dining Credits: *This is one of those benefits that those living in larger metropolitan areas will be able to easily take advantage of this as you simply use your card to pay for the bill at at participating restaurants.

- *Value $120-Lyft Credit: This is automatically added to your Lyft account as a monthly $10 credit

- *Value $240-Apple Music + TV+: I am pretty stoked about this as I actually hate paying for streaming services so this one is personally near and dear to my heart

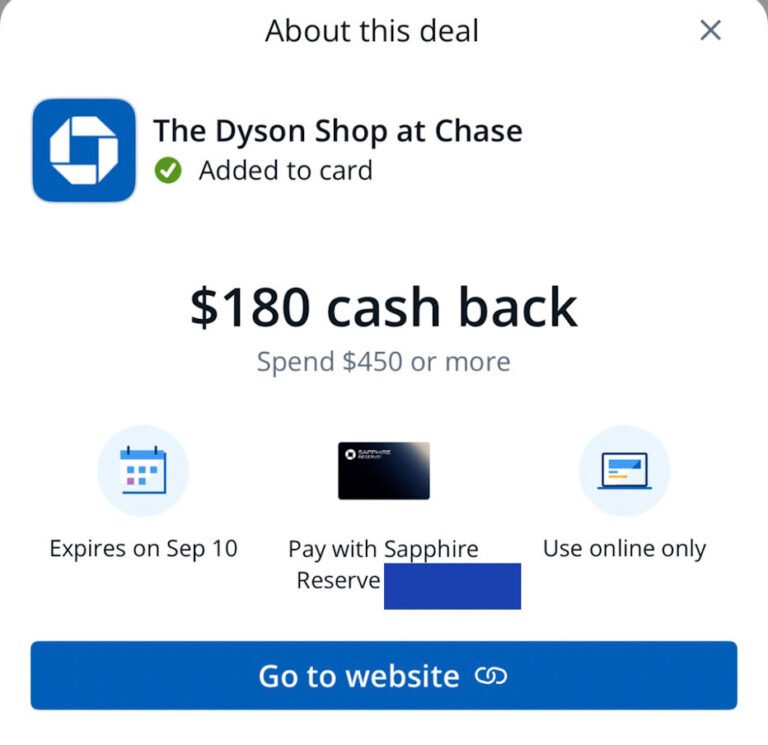

The first three benefits are ones that most will be able to take advantage of and would offset $700 of the annual fee already and using other benefits would have it be where Chase is paying you to have and use the Chase Sapphire Reserve…and that’s even before talking about the value of the sign up bonus 125,000 points! (And don’t forget that there are the Chase offers – a topic that I will cover in one of my next posts!)

Want to learn the basics of travel hacking: Intro to Travel Hacking and then dive deeper with my 8 Top Tips For Travel Hacking

Hot Take on the Benefits and “Coupon Book”

If you are not traveling enough to easily use the $300 travel credit, then this Chase Sapphire Reserve doesn’t make sense for you.

Beautiful tip: putting taxes and fees when booking reward flights on this Sapphire Reserve card is a one-two punch with those being offset by the credit and will also have those flights covered under the travel insurance – flight delay/cancellation benefit (but a standalone travel insurance policy would still be prudent!)

I have had so many people talk about how this card can’t be worth it and how they hate how hard the benefits are to use but there is a reason why Amex and now Chase are adopting quarterly and bi-annual credits. Smart business moves on their part- travel hacking is constantly changing and it appears that the days of credit card churning are behind us. They want people who will use their cards – not only for the sign up bonus.

Is it really that much of a pain? For some, they would have easily spent $300 at one meal but for others it might have been that they would have spent $$100-$200 at one of the restaurants participating in the Sapphire Reserve Exclusive Tables Dining.

Bonus: Why Flexible Points Are Great & What You Can Use Chase Points For

In order to transfer to Chase travel partners, you must have either a Chase Sapphire Preferred card, Chase Sapphire Reserve or Chase Ink Business Preferred card

Flexibility is the name of the game with award travel and this card allows you to earn Ultimate Reward Points that can be transferred to Chase travel award partners as opposed to having a co-branded card (one that is tied to a specific airline or hotel).

Why is this important? You could transfer to Chase’s airline or hotel loyalty programs partners so those 125,000 points from your Sapphire Reserve sign up bonus are worth even more than the $1,250 that you would get if you redeemed those points for cash or a gift card! As importantly, because you are not earning in only one program (ie if you were spending only on a United card, then you would have to look at and use United miles to book flights).

How about a nearly FREE business class on Singapore Airlines? The cash value was ~$2,200 but I only paid $5.60 and used 56,700 points.

There’s also many times when Chase will offer a % bonus on transfers so the rate might be 1:1.20, 1:1.25 or even 1:1.5 so your points will go even further as a transfer of 1,000 Chase points would = 1,200, 1,250, 1,500 miles/points to an airline/hotel partner during the qualifying bonus period!

Here are some real life examples of why flexible points are so important with the different ways that I have been able to use my Chase Ultimate Rewards points:

- Hyatt is a darling of miles and points and enthusiasts because they still have a published award chart with reasonable redemptions (note that due to the popularity of many of these properties, there are a number that have since moved up to a higher category*)

- Aspirational stays like spending my birthday at the Park Hyatt Paris-Vendôme (2 nights with cash value of $2,880.25/night that I used 90K points/2 nights)

- Being able to stay five nights at the Hyatt Regency Paris Étoile* and attend the Paris2024 Olympics (cash value of $874/night and I used 18K points/nights

- Exceptional value for using points to stay at Hyatt Place London Heathrow*, Story Hotel Malmo*, Hyatt Place Los Cabos with only needing to use 5,000 points per night when cash rates were $100-$220/night!

- Transfer bonuses have made some of my redemptions even sweeter

- Using 8,337 points (20% transfer bonus to Air Canada) for a $466.08 direct flight home from Cabo (plus I paid $135.73) This also showcases why flexible points are so valuable. If I had a card that was earning only United miles, booking this exact flight would have been 20,000 UA miles so I saved 12,667 points because I had Chase Ultimate Rewards points!

- Using 58,333 points (again a 20% transfer bonus to Air Canada) for a $6,965 business class flight on Swiss Air (plus I paid $73.53)

Want More Help?

Perhaps you should consider the Chase Sapphire Preferred card as your starter card?

- I offer free mini consult sessions if you want to learn more!

- I also have coaching packages to help you learn how to or maximize your points and miles earning INCLUDING some additional ways to meet minimum spending requirements!

PS I’ll continue to sweeten the deal if you’re approved using one of my referral links, I’ll throw in some baked goodies (beautiful tip: I won’t know unless you tell me if you have been approved for a card!)

Because life should be beautiful and delicious – Rosemary

Who else loves their Chase Sapphire card?

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

This offer is a slap in the face as bad as the “best ever one” they had before. “Benefits” are pathetic and annual fee is insaaaaaaane.

At this time is this still available and the best offer?