How to Meet Credit Card Spending Requirements for Sign-Up Bonuses (And What Those SUB Points Can Get You!)

Updated November 14, 2024

In the last post, you learned that sign up bonuses are the quickest and easiest way to earn loads of points/miles!

Reminder: credit cards are ONLY worth it if you can pay off the balance each month! Need to brush up on credit including basics, cards and myths?

To earn a sign up bonus (SUB), meeting the minimum spend requirement (MSR) is key. If you do not hit that $ amount by XX date, you will have given up a lot of points (and we are all about maximizing spend and getting full value of things around here)

Here’s how to maximize your spending to hit that target (simply put EVERYTHING and I mean EVERYTHING on your cards and this is what I mean by that)

1. Use Your Card for All Purchases:

- Everyday expenses: groceries, gas, dining out

- Utilities and recurring bills (phone, electric, gym memberships)

- If the MSR will be difficult for you to reach, simply switch the $ for these (it’s fairly easy to do and you are not going miss out on that SUB!)

2. Surprising Payments You May Not Have Thought to Use Credit Cards For:

- Medical/dental bills, insurance premiums

- You often have the option to pay providers (doctors, specialists, PT) for co-pays, bills with a card!

- Vehicle insurance (car, boat, motorcycle)

- Home expenses

- Beautiful tips: if you currently have an escrow account, see if the rise in property taxes allows you to take this off. You are giving an interest free loan to the bank to pay this + your property taxes! Set up a saving account and transfer over monthly what would have been put in escrow to ensure that you will have the cash to pay off your credit card.

- Insurance (I make a payment for the full annual premium and have never been charged a fee in the 15+ years I have done this)

- Property taxes (some places like Denver allow you to pay this WITHOUT fees!)

- Gift cards (*specifically when you would have gifted cash! AKA how I got over my disappointment in not getting to wrap gifts as my cousins, nieces, nephew have gotten older and said they want GC or $)

- Almost every week, either Office Depot or Staples will offer $ back on X purchase or fee free Visa or Mastercard gift cards! And even if you are not working towards a SUB on the Chase Business Ink Cash, you would earn 5 points/$1!

- Beautiful Tip: DO NOT purchase gift cards while meeting the MSR on AMEX cards. It is expressly written in the T&Cs that you cannot and they are known to enforce this!

- Covering the bill and being reimbursed (only consider these if you KNOW you’ll be paid back)

- WORK (if this is an option at all, DO IT! This could range from travel, coffee runs, picking up lunch, to grabbing supplies: check with your finance team)

- Dinners (with payment apps, this is super easy now to be instantly paid back)

- Trips (family/friends trips)

- If you are the one planning a vacay, use this to your advantage and you could see really big dividends! Don’t think so? Check out how I earned over a MILLION points/miles when I planned a big family cruise (and here are the FAQs to that post).

- Caveat: only do this if you are CERTAIN that you will be paid back and set up a game plan + payment schedule. Seriously – if you feel uncomfortable discussing money and logistics like this, you should not be taking on this financial risk. I have never had this go south but I have heard too many horror stories to not stress this.

3. When Paying a Fee Makes Sense:

- If it’s your only way to meet the MSR, a small fee can be worth it!

- Paying 2% on your federal taxes owed

- Paying 3% tuition/day care expenses

- Beautiful Tip: if you are paying a fee as your only way to hit MSR and the bill is greater than the MSR, pay only the MSR amount and the rest in cash to avoid unnecessary fees

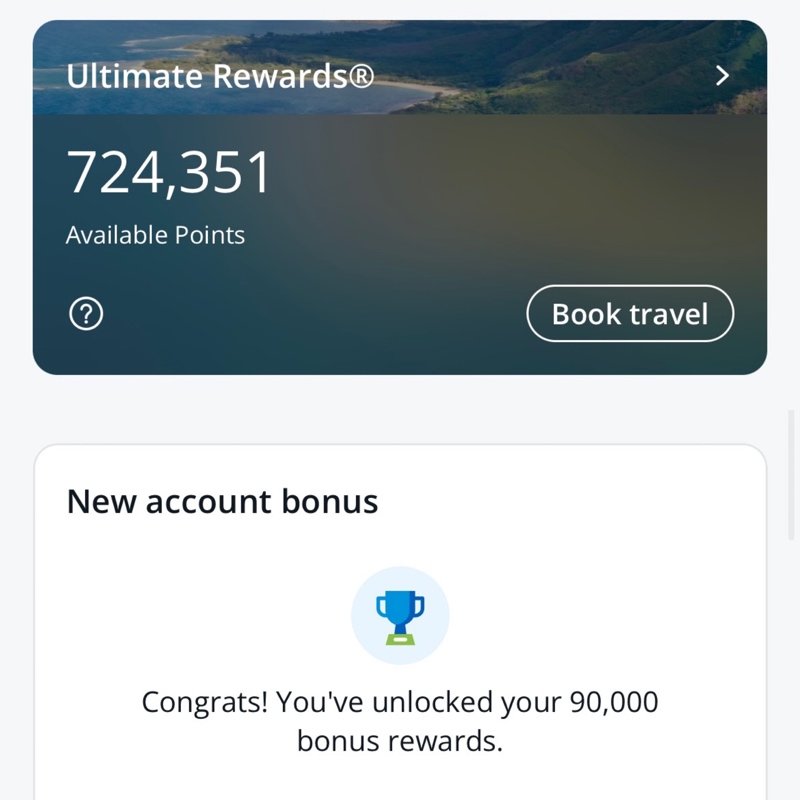

- Why/how? Let’s say you open a new Chase Business Ink Unlimited , you would be paying $180 for the elevated 90K SUB. Check out the what you can use those points for and tell me if those would be worth that fee?

4. Beautiful Tips/Hot Take:

- There are times that you will not use your credit card and that’s perfectly okay (this is life and just max out all other times you have the opp!)

- Some small businesses may not accept credit cards due to fees. I have heard many others in the points/miles sphere tell people to take your business elsewhere then. But I think that supporting trusted and/or small businesses is often more valuable than earning points!

- Trying to pay individuals (e.g., babysitters, daycare providers) with gift cards instead of cash/sending $ through payment apps. There is an inherent power differential here and someone may agree to this only because they don’t know how/or have a hard time saying no and really need the cash (the gift cards are easy to use but don’t allow everyone to substitute for $ ie to pay bills, fill gas, cover rent)

- Take note of the date that the SUB must be completed by (organization is key when travel hacking so set calendar reminders if needed!)

- Do NOT wait until the last minute/day to hit the MSR! A charge may not post on that day due to a variety of factors and you do not want to miss out on your SUB!

- And don’t cut it too close with the MSR, better to be over by a few hundred dollars than miss out because your math was incorrect. While I am all about maximizing spend here, I also want to ensure that you are set up for success =)

Want to learn more about how to travel for cheaper, better and/or more often?: Intro to Travel Hacking and my 8 Top Tips For Travel Hacking

BONUS: What those SUB points can actually get you:

If you got a new Chase Sapphire Preferred card, with a MSR of $4K in 3 months, you could earn 64,000 points (SUB + regular points). How about a lie-flat business class seat on Singapore Airlines which cost me 56,700 Miles + $5.60!

The Chase Business Ink Unlimited has an elevated 90K SUB right now with a MSR of $6K in 3 months which would take care of a two night stay at the Park Hyatt Paris Vendome!

Interested? Support me by using my referral links for these cards (click on the links above!).

NEED HELP?

- I offer free mini consult sessions if you want to learn more!

- I also have coaching packages to help you learn how to or maximize your points and miles earning INCLUDING some additional ways to meet MSR!

PS I’ll continue to sweeten the deal if you’re approved using one of my referral links, I’ll throw in some baked goodies (beautiful tip: I won’t know unless you tell me if you have been approved for a card!)

How have you been able to maximize your spending with new cards and sign up bonuses?

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

I adore reading and I conceive this website got some really useful stuff on it! .

You got a very superb website, Glad I observed it through yahoo.

Its like you read my mind! You appear to know a lot about this, like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a bit, but instead of that, this is magnificent blog. A great read. I will definitely be back.

I used to be very happy to seek out this web-site.I needed to thanks for your time for this excellent read!! I positively enjoying every little little bit of it and I have you bookmarked to take a look at new stuff you weblog post.

he blog was how do i say it… relevant, finally something that helped me. Thanks

F*ckin’ tremendous things here. I am very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you kindly drop me a e-mail?

Wow! This could be one particular of the most helpful blogs We’ve ever arrive across on this subject. Basically Wonderful. I’m also a specialist in this topic therefore I can understand your effort.

It?¦s actually a great and helpful piece of information. I?¦m happy that you just shared this useful info with us. Please keep us informed like this. Thanks for sharing.

I like this blog so much, saved to favorites.

I’m still learning from you, as I’m improving myself. I absolutely enjoy reading everything that is posted on your website.Keep the posts coming. I loved it!

I believe you have observed some very interesting points, appreciate it for the post.

Fantastic website. A lot of useful info here. I’m sending it to a few friends ans also sharing in delicious. And obviously, thanks for your sweat!

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Thank you

I like this web site so much, saved to favorites.

I love the efforts you have put in this, thank you for all the great blog posts.

Hey would you mind sharing which blog platform you’re working with? I’m looking to start my own blog soon but I’m having a hard time deciding between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your layout seems different then most blogs and I’m looking for something unique. P.S Sorry for getting off-topic but I had to ask!

I will right away grab your rss as I can’t find your e-mail subscription link or e-newsletter service. Do you’ve any? Kindly let me know so that I could subscribe. Thanks.