Credit Cards: Sign Up Bonuses (AKA the Quickest Way to Earn Lots of Points/Miles)

The most frequent questions I get asked after: “are HOW are you traveling again?” or “doesn’t x, y, z hurt your credit” is “HOW are you getting so many points?”

Reminder: credit cards are ONLY worth it if you can pay off the balance each month! Curious about that ?:”doesn’t x,y,z hurt your credit or need a refresher: read credit including basics, cards and myths?

This answer is quite simple: I put EVERYTHING I possibly can on a credit card and I’m frequently spending toward a sign up bonus (SUB).

If you’re asking next: why are you not earning as many points as I have?

Read my answer again: I put EVERYTHING I possibly can on a credit card and I’m frequently spending toward a SUB.

When asked what card are they using, I’ll hear: my United or AA card that I’ve had for a long time.

So let’s take the example of a new Chase Sapphire Preferred card with a sign up bonus (SUB) of 60,000 points if you spend $4,000.00 within the first three months from account opening.

If you are spending on your existing UA or AA card, you would earn ~ 4,000 miles if you spent $4K.

If you are spending on a new CSP, you would earn at least 64,000 points if you spent that same $4K in the 90 days after opening the credit card (SUB plus 1 point/$1 spend but some categories have higher points/$1!)

Add in some business cards (and many of you may qualify for these), you can really see the points add up.

Business cards, like the Chase Business Ink Unlimited, offer even more points. Spending $6K in 3 months on a new card can earn you 99,000 points since there’s an elevated SUB right now!

By using new cards with SUBs, you could earn 163,000 points from $10K in spending versus just 10,000 points on an existing card.

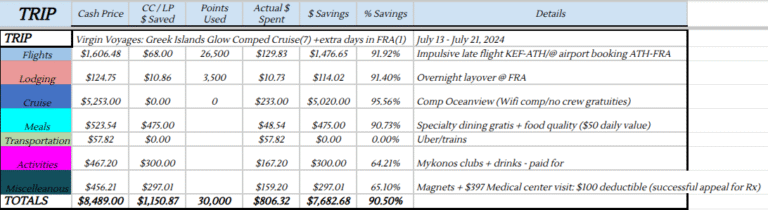

One last example: if you spent $30,000 on a credit card a year (~$2.5K/month) and put that on a cash back card that pays 1.5-2%, you would earn $450-$600 cash back.

If you decided to put that same spend on new credit cards and earned multiple SUBs instead, you could earn 400,000 points just on the SUBS which could be two round trip BUSINESS class tickets to Europe and an EIGHT night stay at the Hyatt Regency Paris Etoile which would be worth significantly more than $450-$600 in cash, no?

Interested? Support me by using my referral links for these cards (click on the links above!). I am also offering free mini consult sessions if you want to learn more!

Next post: How to meet spending requirements for SUBs.

PS I’ll continue to sweeten the deal if you’re approved using one of my referral links, I’ll throw in some baked goodies (beautiful tip: I won’t know unless you tell me if you have been approved for a card!)

Want to learn more: Intro to Travel Hacking and my 8 Top Tips For Travel Hacking

Have you been able to maximize your spending with new cards and sign up bonuses?

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

Hey! Do you use Twitter? I’d like to follow you if that would be okay. I’m undoubtedly enjoying your blog and look forward to new posts.