Credit: Basics, Cards, Myths

Most Recent Update: August 20, 2025

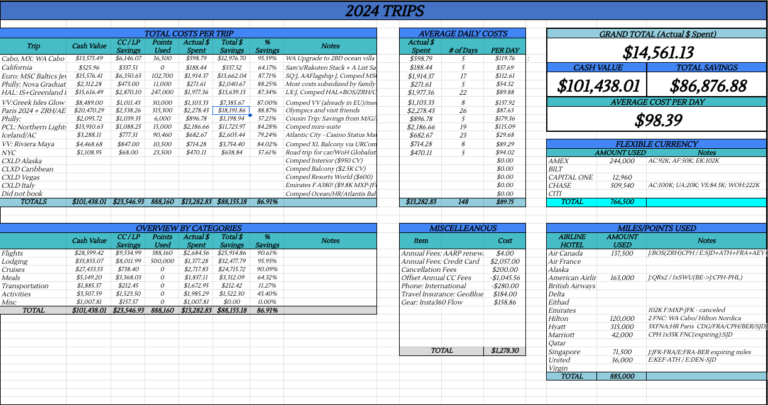

I recently posted on a travel group asking for recommendations on how everyone was keeping track of miles/points/credit cards (IYKYK right? haha – I do plan on sharing what I came up with in a later post since it’s still evolving atm). It’s pretty interesting to see how travel hacking has gotten so mainstream over the years as I had so many people chiming in with great suggestions but there were also many people that were just curious or had many questions about credit/credit cards in general. There was also an interesting number of comments that were perpetuating myths so that post became what I saw as a very cool teaching opportunity. Comments were shut down on that post so I thought it would be good to put this info out into the world as financial literacy is something that I am uber passionate about and have seen firsthand the difference between what happens when you can apply it and what it looks like when you don’t have it.

A little disclaimer (because it’s me) that I am not a licensed financial advisor so this shouldn’t be taken as financial or legal advice. This is based on my years in the banking and financial industry and also on my first hand experiences. Because all situations are unique, YMMV (my fave disclaimer of all time – it stands for “your mileage may vary” meaning that your experience may differ a little or a lot from mine). I’m offering this up because I don’t think that we talk enough about financial matters enough especially in the ways in which one has the ability to have your money work for you.

Let’s start with one of the biggest myths out there: pay for everything in cash and avoid credit cards at all costs. I will not underplay that credit cards can be incredibly dangerous if you allow yourself to spend recklessly and rack up credit card debt. I have seen that happen too often and seen how incredibly damaging that is to people from a mental, emotional and financial standpoint.

Credit cards should be used like a debit card (you spend what you have and no more) so it is something that you pay IN FULL and EVERY MONTH. And it can also be argued that credit is stupid or that is just a construct or even more accurately that it is weird/dumb that these third parties companies can wield so much power but the reality is that our economy is built on it in many ways.

So it is important to know how credit works and also how to use it responsibly – because the reality is that not having credit makes life extremely difficult and costly in a different way. Credit checks are done for everything from applying to certain jobs to renting an apartment to purchasing cars and houses to even being able to open a checking account and your credit score can determine if you get a place or car and as importantly, can either save or cost you more money in the long term.

So what is credit score – it measures your ‘credit worthiness’. Basically the three credit bureaus put all information about your credit into a model and based on different factors will then determine a number that lenders (or others) will use to approve or deny you but also on loan products, the rate which you will pay.

While your credit score isn’t the only thing that that is looked at (employment history and income, etc will also be included), it does play a very important role in the decision. For something like a mortgage – the difference in interest rates over the course of 30 years can add tens to hundreds of thousands of dollars on the amount that you would pay back the bank!

And one of the quirks with lenders/landlords – that having NO credit can be just as limiting as having bad credit.

One thing that I think is often overlooked when discussing credit and credit scores is that they are extremely fluid. What I mean by that is that they naturally will go up and down and people often think of them as something set in stone. Why is this important? I think that what goes into the scores and then understand why they fluctuate but also gives you the ability to know: are the deviations for my scores concerning? As importantly, if you are in a position where your credit isn’t what you would like it to be – to figure out how to start improving them and to have hope that you can improve your scores. So let’s first dive into what goes into the scores and then some more of the myths around credit, scores and cards.

PAYMENT HISTORY – By far the most important thing that you can do for your credit score is to pay your bills on time! For most people, the easiest way to ensure that this happens is by setting up auto pay for the FULL amount. I take a different approach since I need to make sure that I have everything categorized for tax purposes, so I take one day a month when I quickly reconcile my statements and then set up payments – I set it up so that the full amount comes out on the due date. It’s not as easy as auto pay but I like it since it forces me to look at transactions on a monthly basis (waiting until tax season would be horrific!) and also gives me a chance to review charges (if you have auto pay set up, it’s a good idea to look at your account periodically to make sure everything is legit). One late payment will cause a score to quickly drop and the more delinquent it is (how far past the due date it has been), the more it will impact the score. But this is also how you can start to improve your scores, by consistently making on-time payments. The way to think about this is your credit score is a measure of how likely you are to repay a debt and your payment history is the record of how you have been paying what debt you already have (and the more recent the information is more important because it can shed some light on your current situation) and that’s why it is so important in the score.

CREDIT UTILIZATION – this is listed as credit usage/total balances and amount of debt respectively – what this translates to is how much you owe and in relation to how much available credit you have. So if you owed $100 and have $1000 in available credit, your credit utilization would be 10%. General consensus is to keep this number under 30% but the lower this is the better. One thing to note is that even when you pay off your cards in total each month, your number will not be zero. This is because the lenders report to the credit bureaus monthly and whatever your balance is at that time is what gets reported. Remember when I said that your score is in flux, this is one of the main reasons why. These factors are the next most important component of your credit scores because lenders view this through the lens of: is credit being used responsibly? If you are near max or maxed out on your credit line and high credit utilization will cause your scores to drop significantly because the models use this as a predictive factor in you being a higher credit risk. Remember that these two top factors account for 65 – 75% of your score!

CREDIT HISTORY – this is the length of time an account has been open and also includes information about closed accounts (including who closed the account (lender or you) and reason for closure. The most important thing here is to keep your oldest account open because it can dramatically change your score if you (or the lender) closes that account. The longer of a history you have, the higher your score because you have proven over a long period of time that you have been a lower credit risk.

CREDIT INQUIRIES/NEW CREDIT/CREDIT MIX: These are all small factors but play a role because a number of recent credit checks (also known as inquiries) and new credit lines may signal to a lender that there is a change in financial position in combination with higher credit use. These factors do play into your credit score but are a small percentage so not as important as many believe them to be. And credit mix is a weird one (imho) as if you have a credit card, home loan and auto loan will weirdly boost up your score but again credit score is nothing more than a number of factors put into a scoring model that helps a lender determine credit risk.

COMMON MYTHS and misconceptions:

I cannot stress this point enough that credit scores are constantly shifting and when your credit is run (checked by a landlord or a lender), it is one specific point in time. There are things that will affect it but many of the comments on my post about how I was ruining my credit was simply untrue as addressed below:

GETTING NEW CARDS will hurt your credit score: this is one that many have been telling me since I get a new card or two every year for a good sign up bonus. The inquiries may cause your score to dip a little – in my case, I applied for and was approved for two new credit cards: one on March 14 and the other on March 19 and my score went down two points – barely negligible.

CLOSING ACCOUNTS will hurt your credit score: this is one is more nuanced than people understand. The most important thing is to keep your oldest accounts open – so it may be a card or two that you are not using because they don’t earn rewards but you should use them 2-4x/year! I have a few small semi-annual/annual things I pay on my oldest cards and have them set up on auto pay so I don’t have to stress about missed payments or the cards being closed by the lender. If these cards were to be closed, I would suspect that my credit score would be dramatically affected since I have had them for such a long time. With my other credit cards, I have many with annual fees so I am constantly reevaluating them. If I decide to close one, I will always have the lender move my credit line to a remaining card because I know how important credit utilization is to my credit score. Important note: closure is always done after having a card for a full year – if it is within a week to a month (depending on lender) they will refund the annual fee but you don’t want to close it before the full year!

HAVING TOO MANY ACCOUNTS will hurt your credit score: this was also a popular thing I was told – and as you can see by scores that even with getting a card or two every year, my credit score has always been in the exceptional category. I have never been denied for any type of credit and always have gotten the lowest possible interest rates on my mortgages.

There is a fair amount of my score going up and down but my fluctuations are due to balance changes on my credit cards. I don’t escrow for my house because Denver allows you to pay your property taxes by credit card and without a fee! And same for my insurance – home and auto but since I pay all of those around the same time each year, my credit utilization dramatically increases and my score take a little dive. But then everything is paid in full and then the score improves. This happened more frequently in the past two years because of my knee and all of my healthcare costs – surgeries are expensive!

One example of how those myths really aren’t true in a real life example: impulsively decided to buy my current house – after I had gotten a few credit cards in the preceding few months (had just did a big vacation so lots of points were earned) and I had closed other cards that weren’t rewards cards at the same time. And I had no trouble getting my mortgage at an exceptional interest rate. My credit (along with other factors) also allowed this to be a second mortgage I held at the time (so I could take time to decide if I wanted to sell or rent the old house).

A little teaser for my next few posts and the photo that prompted all of the comments (these are almost all the cards that I have open at the moment with the exception of my two oldest cards that I have locked away). I will be digging into some general terms/concepts that are important when thinking about credit cards

I really do love talking about this stuff – so please let me know if there’s anything I can clarify or if you have any other questions! Or what you would like addressed in another post!

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

![[EXPIRED] Chase Sapphire Reserve Revamped with BEST OFFER EVER 100,000 Points + $500 Promo credit](https://beautifullifebeautifulworld.com/wp-content/uploads/2025/07/image-2-768x341.png)

I’m so happy to read this. This is the type of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this

so much great information on here, : D.

This web site is really a walk-through for all of the info you wanted about this and didn’t know who to ask. Glimpse here, and you’ll definitely discover it.