1.088 Million Miles?! What?! HOW? – FAQs

I’ve gotten quite a few questions about my recent points haul post so thought it would be helpful for some to see my answers. Here’s the first part to the most frequent FAQs! Recap/refresher: in four and and half months, I earned just under 1.1 million points (and miles!)

Q: How was this even possible?

Here is the most important takeaway: while this is definitely an example taken to the max, I share it to underscore the basic rules for travel hacking. The role of credit cards and sign up bonuses are key. Take advantage of opportunities. Maximize spend. In many ways, it really is that simple.

But I also need to point out that this was EXTREMELY AGGRESSIVE and I would advise you against from attempting this as I did exactly. Mainly that it was a very short period of time to have opened so many new credit cards. Which leads to:

Q. How much has your credit fallen? Aren’t you worried that this will negatively affect your credit score?

It’s interesting how many people still tell me that travel hacking with credit cards like this will be disastrous for my credit scores. I have been doing this for over 20 years now (had my first redemption in 2004), and I have NEVER been denied for a credit card, loan, or any other financial product. I understand how credit works and use it to my advantage. At most, one score dipped 15 points but they were/are all over 800. Good time to interject that your scores are constantly in flux, there are natural ebbs and flows but it’s the trends that you need to watch for. So if it’s not just a momentary dip, it might be time for an adjustment to your plans. Pay attention to what’s most impactful to scores: pay off balances, make on time payments, keep credit utilization low, and maintain a long credit history by keeping your oldest card(s) open.

Caveat: please only consider if you pay off the credit card IN FULL every month because no reward amount can justify interest charges as the interest amount you pay will always exceed any rewards you earn! If you are new to credit or need a refresher, here’s a little primer.

Q: Why do you say I shouldn’t try to match your numbers?:

Over a million is an impressive number to be able to brag about and to be able do it in 19 weeks well~ STOP maybe it’s best to think about that statement as it’s just clickbait material. So if a million points is your goal: great, it’s achievable for sure! But the Econ nerd in me wants to remind you, that sitting on miles is not a smart play since they’re losing value ~ earn and burn baby.

I say YMMV a lot and it means your mileage may vary or more simply, your experience may not be similar to mine. I’m fairly confident, it will almost not match up. It is not JUST the amount of points that is insane, it’s the very shortened timeframe that I used to get those points that is what makes it bonkers!

Q: How on earth did you get EIGHT credit cards in three months?

For those curious, I won’t go into what the the individual cards are but I will list out the issuers of the cards and (date approved): AMEX (3/16/23), Capital One (3/17), Chase (4/16), AMEX (5/12), Barclays (6/6), Chase (6/8), Citibank (6/22) and AMEX (6/22) with a mix of personal and business cards. All but one were instantly approved (and even that one was approved the same day) ~ and yes, really still no denials ever, never been in AMEX pop up jail, and all three credit scores remain above 800.

Here’s me minding you how this is high rate of opening accounts and I certainly would recommend going a lot slower with opening new cards. The reality is that you need to stay in the good graces of these banks. I cannot stress enough that this was a calculated risk. Part of it was I wanted to really push the envelope (if you know me, lol this is a typical Rosemary experiment because I’m curious!). But I was very confident in how strong my credit profile/low my risk profile were plus I have had long standing accounts with Amex, Chase and Capital One ~ enough so to push it with the last four cards obtained in just over two weeks.

I should also note the two biggest reasons I decided to go big is 1: I don’t typically have a lot of spend. 1-3 new cards a year is my average so it was a bit too enticing not to take advantage of this prime opportunity. And 2: this situation shows why I stress finding your why/what for travel hacking. Because it does take time and energy but for me, those points were the light at the end of the tunnel from planning a very stressful family trip and what I quaintly (naively?) thought was the end of my recovery and the beginning of my return to travel en force.

Q: How are you earning so many points? I put everything on my card and it’s maybe 40,000 – 60,000 points in a year!

Don’t understand how a sign up bonus works? Read this

Your normal annual spending on one card will not reflect the true earning potential of those dollars. To put it another way, you’re not making your money work as hard as it can. It can always work harder as you work smarter.

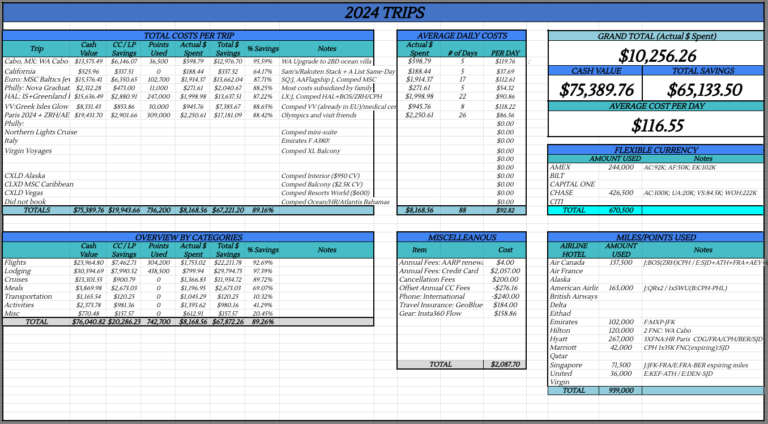

Case in point: the spend in this time period yielded 86K points. While this is no small number, it is dwarfed by the 685K that I earned from sign up bonuses. Compare that 8% of the total 1.088 million points earned was from using a credit card VS 63% was from taking a chance and opening up so many cards. A few things I want to highlight: $86,000 was NOT how much was charged as many if not most spend earned more than 1 point/$1 and I still am working towards completing the minimum spend req for my eighth welcome bonus. I looked at it as if I hadn’t opened up these new cards, I essentially would have been leaving over 800,000 points on the table. Same for you and your spending on your one card ~ it’s a lot of points that you’re not earning by not maximizing welcome/sign up bonuses.

I want to leave you with this thought and a little story: Credit cards are not inherently bad or even good but they are powerful ~ you can find yourself in a position of cyclical and crushing debt with them or they can be a way to make your money work for you.

Haha I know it’s hard to believe but I was young and dumb once. Sure I could blame it on my terrible roommates that bailed on me (blessing in the long, long run) and having to cover rent on a three bedroom place. But it was also just stupid and frivolous spending that brought me to my knees my second year of college. As a 19 year old, I was staring at over $11,000 in debt! So I (hilariously/ironically?) ended up getting a job at a bank. I started out working part time but ramped up to full time whilst attending uni full time. I put myself on a strict budget and paid off the debt in 15 months. I will note that I had scholarships that covered tuition, books, fees and part of the housing so I was able to put a lot of earnings towards getting rid of that monkey debt off my back.

So I understand the allure of what feels like easy money when it comes to credit cards. They may not be right for you if you don’t think you won’t be able to control your spending. I can’t tell you if that’s something that really might be the outcome or if it’s something that others taught you to fear. I urge you to seek the path that works for you. The way things are set up currently in the US with how richly we are rewarded for responsible credit use is an incredible opportunity and one that others in many other countries don’t have or not anywhere near the level we have!

I know that I am thankful for that experience. I learned to dig deep into my feelings about money and examine those along with other things that society said was important. I discovered that what I value most are not things or keeping up with the Jones but experiences and connections were what I sought out. So I figured it was a good time to reset habits and define for myself what was important and necessary. Set up savings accounts, learned about investing, put away money for retirement, and vowed to only use credit cards if I could do responsibly.

I was lucky in that one of my uncles traveled a lot for work and also really utilized his credit cards/points/miles. He was instrumental in getting me into the points game and also introduced me to FlyerTalk and SPG (RIP and iykyk why that loss still hurts even now years later!). And also was incredibly generous not only with his knowledge and time but also gifted me award flights to London! My life would never be the same after seeing for myself, how award travel worked. It started with that flight and then with the SPG card, and I really learned how credit cards could benefit me if I was willing to be dedicated and disciplined. If travel was the goal, I would do what it took to do more of it. Also happens that it ended up being a way for it to be cheaper and better!

Hopefully this really showcases how you can making your money work for you and how to capitalize on opportunities – do you still have questions? Or is there a subject that you wish I had gone more in depth about?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

very impressive – PS I found you from the GLT points group!

hi! thanks so much and oh that’s awesome! Let me know if you have any questions or guidance with this!