8 Top Tips For Travel Hacking (AKA How To Travel For Cheaper, Better and/or More Often)

Most Recent Update: August 24, 2025

Originally Published: May 7, 2023

Trav·el hack·ing (noun): strategies and/or techniques adopted to allow one to travel for cheaper, better and/or more often.

It is really as simple as that.

But as with everything, there are levels to this hobby and the complexity lies in the effort that you are willing/wanting to put in. Travel hacking simply allows you to travel at the most base level and continues up to maximizing how you travel so it really can be simple or complex.

This goes a bit further here than my Travel Hacking intro but I still consider this to be a basics 101 post with tips and ways to shift your thinking to get you started. This is the foundation of setting you up for success and you can decide on how much further you would like to go – and I will introduce some ideas on the next steps you can take and/or how to level up.

Note that this list is focused on credit cards (and SUBS) to get more points and miles to minimize your travel costs. So if you wanted to travel better (but cheaper) and are not in a position to get a credit card now, this list will be more beneficial.

#1- Figure out your “WHAT(s)/WHY(s)”

The starting point should begin with: WHAT do YOU want to accomplish? This is a highly personal question because only YOU can answer this. Remember that there is no wrong answer here because what you want doesn’t have to be what another person or even I want from travel hacking.

And be prepared that this is like life, in that your wants will be constantly evolving – maybe even from trip to trip. Some ways to think about this are/questions that can answer the what part: do you want to be able to: save as much money or spend as little out of pocket cash as possible? Stay somewhere on your bucket list? Take an aspirational business or even a first class ticket? Travel more? Save money on hotels/airfare so you can spend more on experiences?

WHY is secondary and may simply be to be able to travel more or be a bigger goal with being able to have your kids see and experience more of the world to something as profound as finding/defining yourself again through travel.

I urge people to start with these two questions because there are so many people that are now travel hacking and in combination with social media, comparison is the thief of joy. So just remember that if you’re traveling and were able to do what you set out to do then you’re doing great! I have seen so many people ask on forums how they did on their first redemption and you can feel their excitement slowly fade like a balloon with a small hole or worst, burst like a bubble with the comments about how this isn’t a good use of points (the last tip will really dive into this). We’re all at different points in our journeys and it’s easier to feel the joy this should inspire by being able to travel by referring back to your WHAT/WHY.

Caveat: please only consider if you pay off the credit card IN FULL every month because no reward amount can justify interest charges as the amount you pay will always exceed any rewards you earn! If you are new to credit, here’s a little primer.

#2- Accept (and then learn to MINIMIZE) Credit Card Annual Fees

So there may be a few or a lot of you that will balk at this and it might be helpful to know that many years ago I was also you: “but there’s an annual fee (AF) – why would I do that when I have XX credit card that is FREE?”

First, let’s delve into the idea of the annual fee – I started to think and explain them differently in that these should not be lumped into the category of a late fee or worse ticketing fees for concert tickets since we all HATE those (ugh looking at you: Ticketmaster and AXS)!

What if instead we changed how we thought of annual fees? And viewed them more along the lines of a subscription service: you are paying for access to be able to collect points faster than you could without this service.

The AF will more than pay for itself by earning points that far exceed the value of what you would have received on a no AF cash back card. Plus some cards have additional perks that help offset the annual fee even more such as the Chase Sapphire Preferred and the travel and purchase benefits that comes with the card: for more info, read this. Plus there is a limited time elevated offer on this card which is basically eliminates the annual fee of the card for THREE YEARS now expired (along with the sign up bonus which brings me to the next tip)

Or the other way that I have heard them described is would you pay $95 for $750 (but really more if you are transferring points to Chase travel partners) – that is the annual fee for the Chase Sapphire Preferred that has a $95 annual fee with a sign up bonus of 75,000 points currently

LEVELING UP: there are many ways to minimize, completely offset your credit card annual fees. Learn about and use the benefits that come with your credit card especially on cards that have high annual fees ie here’s the breakdown for Amex Hilton Aspire or Chase Sapphire Reserve

#3- Embrace that credit cards and large sign up bonuses (SUBs) are how you quickly build up a lot of points

Beautiful Tip: if you are traveling for work, check with your company and see if you can put the travel on your credit card and be reimbursed – this will build up your points even faster especially with the ability to earn even more SUBs!

This is travel hacking at its finest since it’s doing something in a clever or efficient way and earning miles/points without flying and staying in hotels!

For many people, there is no other way for many people to gain as many points/miles quickly than getting credit cards with sign up bonuses. Spending $10K with opening two credit cards (and accompanying SUBs) could net you 163,000 points (which could be eight nights at this Paris hotel) which is worth more than the $150-$200 you could earn on a no annual fee credit card earning 1.5-2x cash back or 10,000 points on the United card you have had for years…

Read this for how SUBs are the fastest way to build up your points and read this for how to meet the required spend for SUBs

LEVELING UP: there are many ways to minimize, completely offset your credit card annual fees. Every credit card that I have PAYS ME to have the card over the year, typically before even taking into account SUBs! Besides maximizing the benefits for my cards, I stack spending with using Amex and Chase offers that have given me thousands back and earn ten of thousands of points with – learn more about these here

#4- Understanding that not all points and miles are created equally

This concept is one that trips quite a few people up because it doesn’t quite make sense at first why the Sapphire Preferred card is recommended as the first credit card to start with. Besides the exceptional value it offers for a low $95 AF, the main benefit is that you earn Chase Ultimate Rewards (UR) (which are points with a specific bank’s program). In the travel hacking sphere, these are referred to as flexible currency (because you have the ability to transfer to multiple partners). The reason why this is helpful is that you are not limited to just one hotel or airline when you go to redeem your UR (as you would have been if you spent on a card that earned just United or Marriott aka a fixed currency) as Chase has many transfer partners. And there’s more, Chase will run periodic transfer bonuses for these partners allowing you to get even more bang for your buck!

*That’s not to say that co-branded cards don’t have a place as you advance in your travel hacking journeys. And if you currently have one or two, it might make sense to keep the cards especially for hotels as those cards can come with a free night greatly outweighing their AF or for an airline, if you fly them often enough and need a benefit like a free checked bag.

But knowing that not all points are created equal is very important when you are looking at sign up bonuses since you might be inclined to say that there’s a Hilton with a SUB of 130K points which is 55K more than the Chase Sapphire Preferred so you think “I should definitely go with the Hilton card.” It is important to know that Hilton hotel rooms can be 70K-120K/night for popular destinations such as NYC for a weekend night and can go up to 150K for a standard room for certain destinations (assuming you can find availability!) vs having the Chase Sapphire Preferred that allows you to transfer to Hyatt with redemptions topping out at 45K/night.

LEVELING UP: if you are looking to use your flexible points for flights, understanding how airline alliances work and who partners with whom is something that you should learn and leads to my next tip.

#5- Sign Up for and (then learn to MAXIMIZE) Airline and Hotel’s Loyalty Programs (LP)

The next step after you open a card that earns flexible currencies, is to set up accounts with the bank’s travel partners. Why? Because to get the most value out of your points, you would transfer points to a hotel or airline’s loyalty program.

Beautiful Tip: set up your name on the loyalty programs to match your name on your credit cards to make things seamless when you make your transfer.

A little info about loyalty programs: they give you the ability to earn miles (or points respectively) when flying or staying with that brand and at X number of miles/points, you would be able to redeem for a free flight (night at hotel).

There’s an incentive for the airline to do this as it build loyalty through a person wanting to earn on all their flights with XX airline to 1: earn free flights (and this can be from domestic economy to international first class) and 2: to earn elite status which can reward you with complimentary upgrades to free lounge access to other rewards depending on the LP!

LEVELING UP: there are many, many levels that you can delve deeper with loyalty programs. The first is by learning about the ones that you may use often and seeing/understanding any advantages that you may get to fly/stay with them more frequently. Second is finding sweet spots within LP or alliances (a peculiar reality is that often the best redemptions are with a partner airline’s not the airline’s own LP! And lastly, maximizing a LP can entail obtaining a high level of elite status. A hot take to many in the hobby as most people tend to go with where the deals are. But I know that in this day and age of crazy issues traveling, being able to call AA’s Executive Platinum or Hyatt’s Explorist phone numbers have been time and sanity savers for me!

#6- Realizing that this hobby takes effort, practice and time

Go back to your WHAT and WHY for you’re hoping to achieve with travel hacking – know that the more aspirational or involved those are will have a direct correlation to how much effort, practice and time that you will need to put into this.

For those finance/econ nerds like me out there, I think of it as ROI or return on investment which is when you calculate the monetary value of what was gained versus the costs associated or simply your flight/hotel/trip worth $XX versus how much time you spent learning about loyalty programs, practicing award searches, etc.

Side note: whilst we live in an era where there are now flight and hotel award availability search tools, you will need to know how to search for award flight yourselves since many of these tools are not updated in real time and some airlines are pushing back (with lawsuits to remove their LP awards flights from these sites). They are useful to help you look especially as searching can be frusterating but use them as a tool in your arsenal vs being a crutch which hampers you in the long run.

LEVELING UP: if you thought that there were many, many levels with loyalty programs, then it will blow your mind with how deep you can go in this game. A few of my favorites are with status matching for airline loyalty programs, maximizing spend and casino status match jackpot!

#7- Flexibility is key and be prepared to act quickly!

To be able to book business or first class tickets at saver rates or on dream/aspirational airlines does take a lot of work and a bit of luck. What is luck anyways but opportunity meeting preparation for award searches so put yourself in a position to succeed which segues nicely into this next tip!

When you are booking flights and hotels for popular destinations during peak season, you will be able to leverage your points better if you are flexible. My buddy was able to get a killer deal to Paris (here’s how we did it) by leaving a day earlier. If you are looking to book award flights – you normally have to start looking the moment it is released if you are searching for the more elusive and scarce business or first class awards OR if you have flexibility (or if you are comfortable with booking refundable fares in hope of something popping up), I can attest that waiting to look three months out has been successful but often times, the absolute best availability for those seats become available a week to a month out.

I was able to snag an EVA business class seat literally TWO days before I left to Thailand (one of the most EPIC redemptions I had ever pulled off!). When booking award flights, the key is to act quickly because those highly coveted seats may not last – often, it might be beneficial to put the reservation on hold. This will allow you to make sure you can take the time off and see other arrangements will pan out and better to lose a small fee if things don’t work out then missing out a great redemption that was quickly snatched up by someone else if things can line up!

FYI – it is easier to start award booking with hotels because it is less complicated with not needing to know airline alliances/code share partners and/or getting positioning flights, etc. I am partial to Hyatt (partially due to nostalgia from all my time with them and also they really remind me of SPG – RIP my fave loyalty program but I digress as usual). Hyatt with its WOH loyalty program has some of the best values for redemptions due to an award chart still being used combined with reasonable award rates. Unfortunately, they do have a limited footprint worldwide compared to Hilton, Marriott, IHG but that is rapidly changing with all of their acquisitions the past few years but another reason why diversification is important.

#8- Learning the formula CPP (cost per point) BUT also take it with a grain (or really a pound) of salt

How to calculate cost per point (CPP) which is simply how much you would pay in cash for travel minus any taxes/fees that you would pay if using points (in cents) and divide by the number of points needed for the award.

CPP example: booking a hotel room that costs $250 or 10,000 points, you’d be getting a value of 2.5 CPP ($250 x 100 cents/dollar /10,000 points) assuming no resort fees or taxes.

You can compare this to having earned $150 or $200 on a cash back credit card (on $10K spend) or using points in a card issuer portal (which again I don’t recommend) at 1-1.5% so it would cost you 16,6667-25,000 points!

I have a love/hate relationship with this formula and especially its prominence when discussing redemptions.

I think of CPP more as a guide to have more than a specific number that you prefer to hit especially considering that the $ portion is often inflated. What I mean by this is that most people would not have paid the cash fare for business class seat so it’s not really fair to compare that redemption to a family that would have paid $ for a hotel room but instead used points – the former has an artificially high CPP compared to the latter and I have seen people make others feel bad for this exact redemption

Remember your WHAT/WHY – you will find that sometimes it make more sense to pay cash and save your points but there are just as many valid reasons why it may make sense to use the 10K points in the example above if it allows you to be able to meet YOUR reasons even if others are saying that it’s a poor redemption since they always aim for at least 2 CPP.

Whilst I typically aim for the 2 CPP personally, I am also flush with points and have made a few redemptions this year where the CPP was lower than that because I didn’t want to spend the cash!

Also to complicate things, remember how not all points are created equal? Well you wouldn’t aim to get a CPP on Hilton that is equal to UR – which is why I advocate for you to find your own value for your points.

Bonus Beautiful Tip: Make an impact with your money

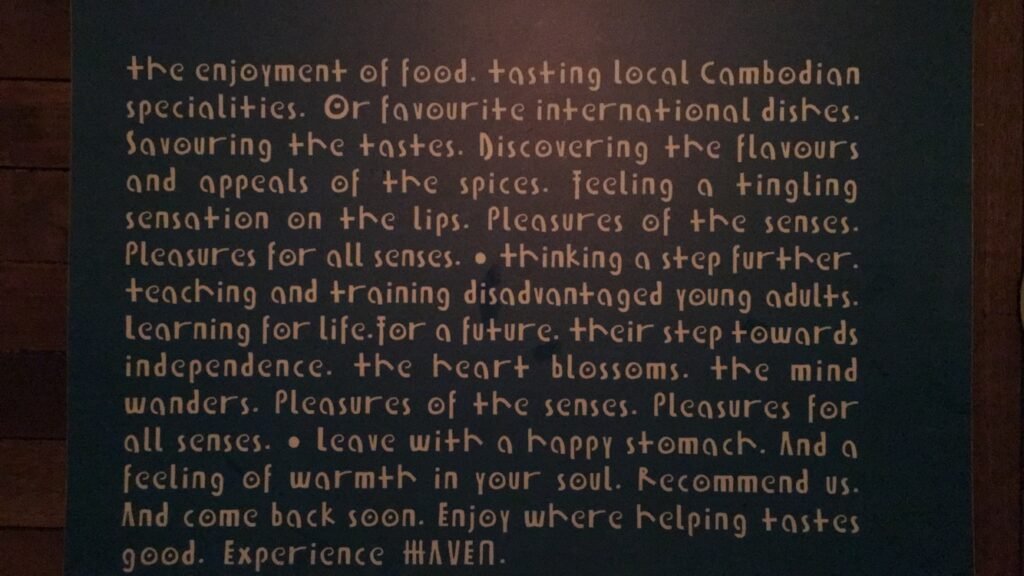

It’s a privilege to travel. Saying this doesn’t undermine the sacrifice or hard work that one may make to go someplace but it does acknowledge that not everyone has this luxury/right. Money is important and can help make a big difference based on how it’s spent. I love supporting local businesses and also seek out places that have a greater social mission. And also choose to support places that are ethical/humane ~ so no elephant riding or tiger palaces and so forth for me.

Last tip: Remember you don’t have to know it all, you just have to know where to look (aka lean on resources!)

(Perhaps I should have just made this a list of 10 tips instead of keeping to my favorite number)

I first started writing about my travels and specifically travel hacking in 2016 and it’s been incredible how widespread travel and credit card hacking have gone seen then – I find myself often in Facebook groups to crowd source information and also to get some inspiration and also learn a lot (ie casino status matches).

But I balance that out with searches on my own as there are so really well researched posts out there. I am not linking a specific site here because this really has become so mainstream that simple google searches are now pretty effective and how I typically start when I am thinking about a trip or want to know which airlines have “sweet spots” for redemptions.

The OG site Flyertalk is the absolute best source of information but note that it is not user or beginner friendly…but if you have an advanced question or really want to dive in – this is the place to go. I have been doing travel hacking now for well over two decades and that was where I learned so many of the ins and out.

If you’re still unsure where to start: I am also offering free mini consult sessions if you want to learn more! And offer many different coaching packages based on your goals

MY WHY: is that I want to live life to fullest and for me, travel is a huge part of who I am. My WHAT is simply to travel more and the adage about the best money is spent on experiences holds especially true for me. Yes my hot air balloon rides were expensive but I will always remember those magical sunrises over Bagan, Burma or Cappadocia, Turkey as seen below. Travel hacking had allowed me to use points/miles for flights so that I could spend my cash on experiences like this!

Hopefully there was something or a number of things that will help you with maximizing your money for travel! Did I miss anything here that you think is a great money & travel tip? Or is there a subject that you wish I had gone more in depth about? Please let me know and I’ll see if I can work it into an upcoming post!

I saw your comment in the HAL casino group – thanks for the post and info.