Amex & Chase Offers: Don’t Miss Out on Potential (Big) Savings

You know by now that I am all about maximizing spend. Start by putting everything you can on your credit cards (and opening new cards for sign up bonuses). Then taking it a bit further with looking at all the ways to earn more points/miles or save with every swipe. Another way to offset the annual fee (or on those no annual fee cards – have the bank pay you for your card) that takes a little bit of work but can have some outsized gains is with the offers you can find on your credit cards.

Please note: this post contains affiliate links which means if you buy something following a link on this page, I may get a small commission. As an Amazon Associate, I earn from qualifying purchases. This is absolutely free for you/does not cost you anything extra! There’s no sponsored content nor do I run ads here so this helps so much in reducing the ever-increasing costs of keeping this site active.Thanks! Rosemary

What Are Credit Card Offers

These reward cardholders with targeted + merchant-specific deals available through each issuer’s programs (ie AMEX or Chase Offers). YMMV as these offers are targeted so often you may receive an offer that another cardholder may not (or sadly the reverse) and can find that for yourself different cards have different offers.

So that bit of work that I mentioned above? It is because these offers are not automatically added to your cards ie you will have to manually go in and activate/add offers. Let’s jump in and see what these are all about and how they can really pay off.

Quick notes: I am not touching on Capital One offers as I have found them to be unreliable in honoring the offers plus I haven’t found more than a couple to be worth the effort for me. CitiCard Offers overlap with Simply Miles offers and then disappear when I activate my Simply Miles. Because I don’t like to write about things that I don’t have experience with and set you up for disappointment, I will not go into CitiCard Offers at this time as I have very avinsgs with those offers.

Beautiful tip: It will take an additional few minutes but you could potentially save hundreds by reviewing your credit card offers before making purchases! Phenomenal ROI =)

AMEX Offers

Amex Offers helps Card Members earn rewards on purchases for things they love. The program gives eligible Card Members the opportunity to earn rewards typically after the Card Member makes purchases at select merchants or within specific industries (depending on the Amex Offer).

Important Notes about AMEX Offers

- Rewards can be earned in the form of Statement Credits (as a statement credit back on a purchase or as a % back in the form of a statement credit on a purchase); or Membership Rewards® points, Delta SkyMiles®, Hilton Honors Points, or Marriott Bonvoy® points on qualifying purchases. The reward is dependent on the offer and Card type.

- If you manage multiple Cards on your americanexpress.com account, only one of the eligible Cards will be able to take advantage of an offer. You can only add an Amex Offer to an eligible American Express Card once.

- Beautiful Tip: If you have authorize users/additional card holders on an account, each card holder may add the offer (if available in their offers)

Enrollment is limited on many AMEX offers.

Beautiful Tip: if you think you might use an offer, add it as soon as possible as the cap is hit very quickly on popular offers

How to Find/Use AMEX Offers

- Log in: to your American Express online account.

- Navigate to the “Offers” section: to explore available promotions.

- Add eligible offers: to your enrolled card – remember that AMEX offers are limited to only one of your cards!

- Check offer terms and exclusions: look at qualifying purchases/eligibility especially if it is a single purchase or can it be multiple purchases total $X.xx and dates – expiration of the offer, etc

- Make a qualifying purchase: at the specified merchant to receive the statement credit or bonus points.

My Personal Experience/Savings with AMEX Offers

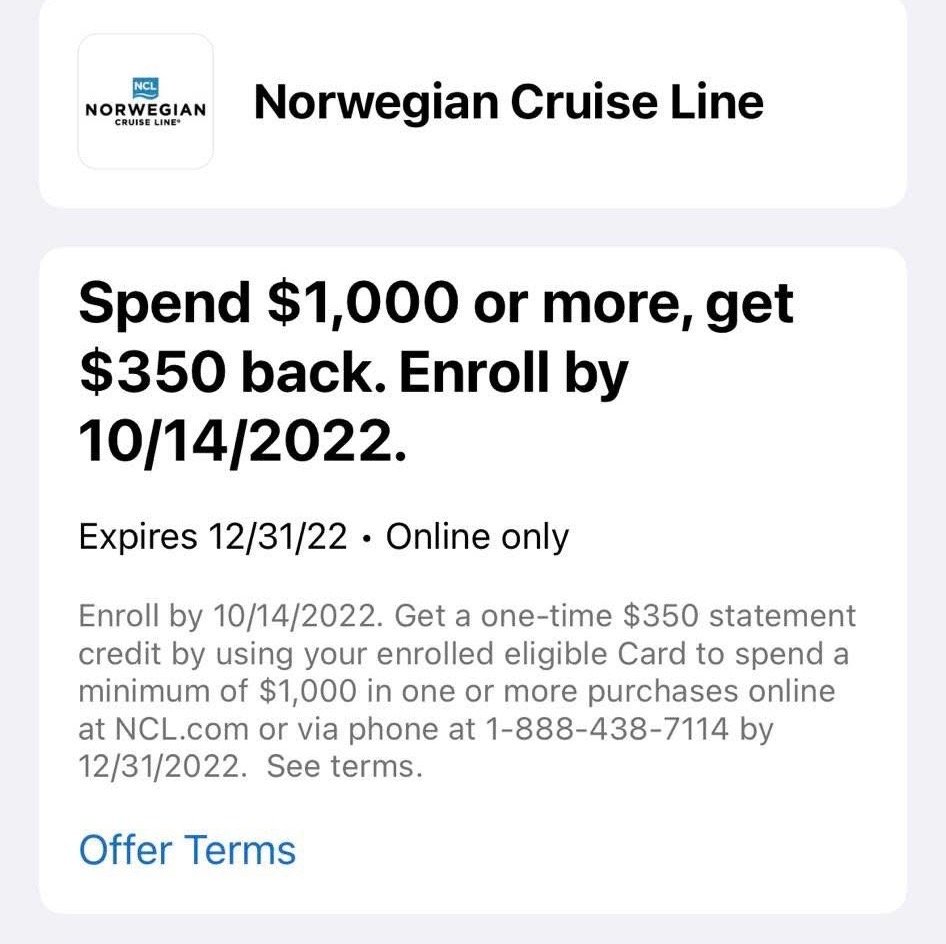

Some of the biggest AMEX offers have been on travel and cruises specifically. The AMEX offers for Norwegian Cruise Line (first photo on left) was massive as I was able to use this on my card and the additional three Platinum cardholders’ offers so saving $1400 – $350x 4 on the family cruise.

- $1400 Savings/35% savings: AMEX offer for Norwegian Cruise Line (first photo on left) was massive as I was able to use this on my card and the additional three Platinum cardholders’ offers on the family cruise!

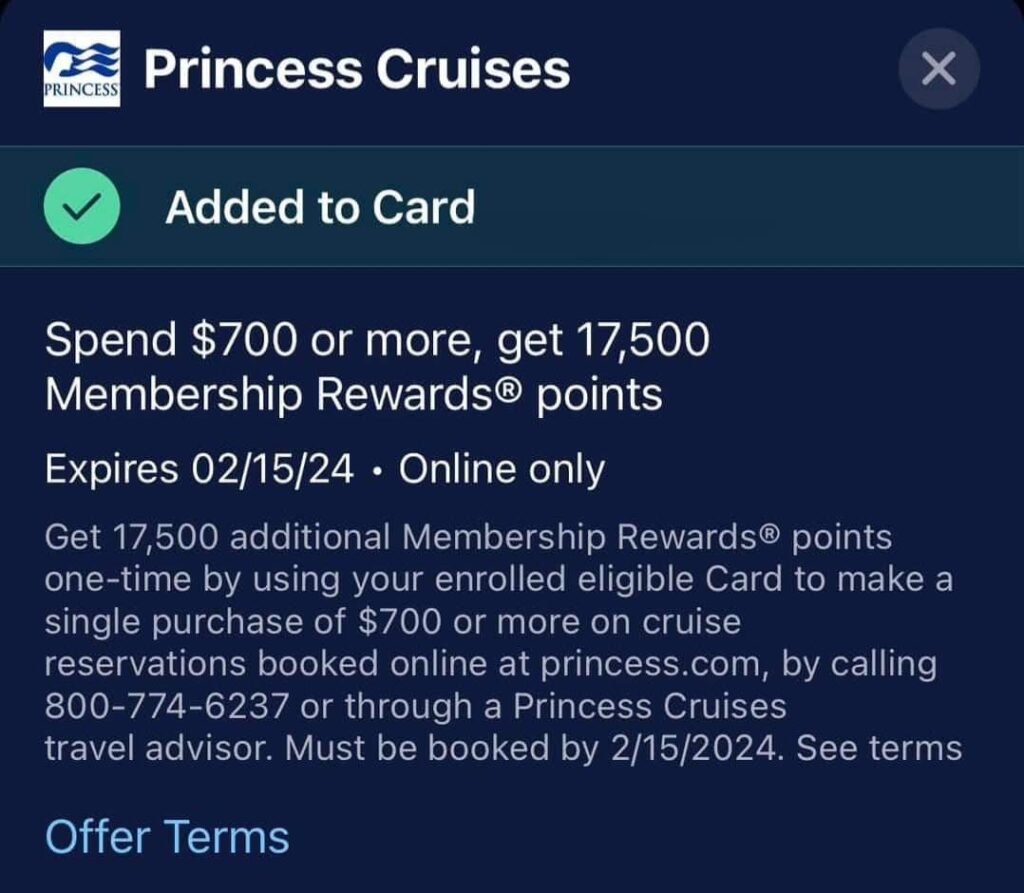

- Additional 17,500 Points: Princess Cruises (middle photo) was a little trickier to hit as this was for a single purchase of $700 and I almost missed out of this offer by not reading the offer terms

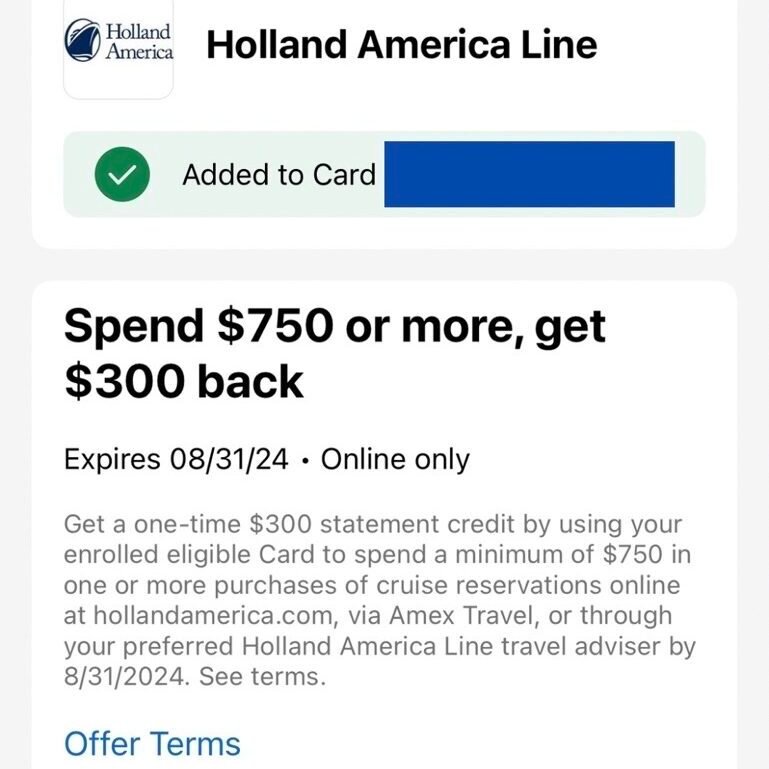

- $300 Savings/40% savings: Holland America Line (right photo) was pure icing on my comp Nordics cruise with saving 40% on the the have it all package/staff gratuities.

- $200 Savings/25% savings: Lowe’s – I had had and used the $50 off $200 or more in purchases AMEX Offer a few times as owning an original MCM home is a constant project

AMEX Offers cash back / MR points typically post within a couple of business days of charges posting to the account

Current AMEX Offers

Chase Offers

Very similar to AMEX Offers but available to Chase eligible credit cardholders as targeted + merchant specific deals for cash back.

Important Note about Chase Offers

- One noticeable difference/advantage for Chase Offers vs AMEX Offers is that you can take advantage of a Chase offer on multiple Chase cards

- The targeted part is very apparent as Chase Offers differ for me from one card type to another card

How to Find/Use Chase Offers

- Log in: to your Chase online account or open the Chase mobile app.

- Look for the “Offers” section: on your account dashboard.

- Activate the offers: you want to use.

- Make an eligible purchase: with your Chase card, and the cash back will appear on your account/statement.

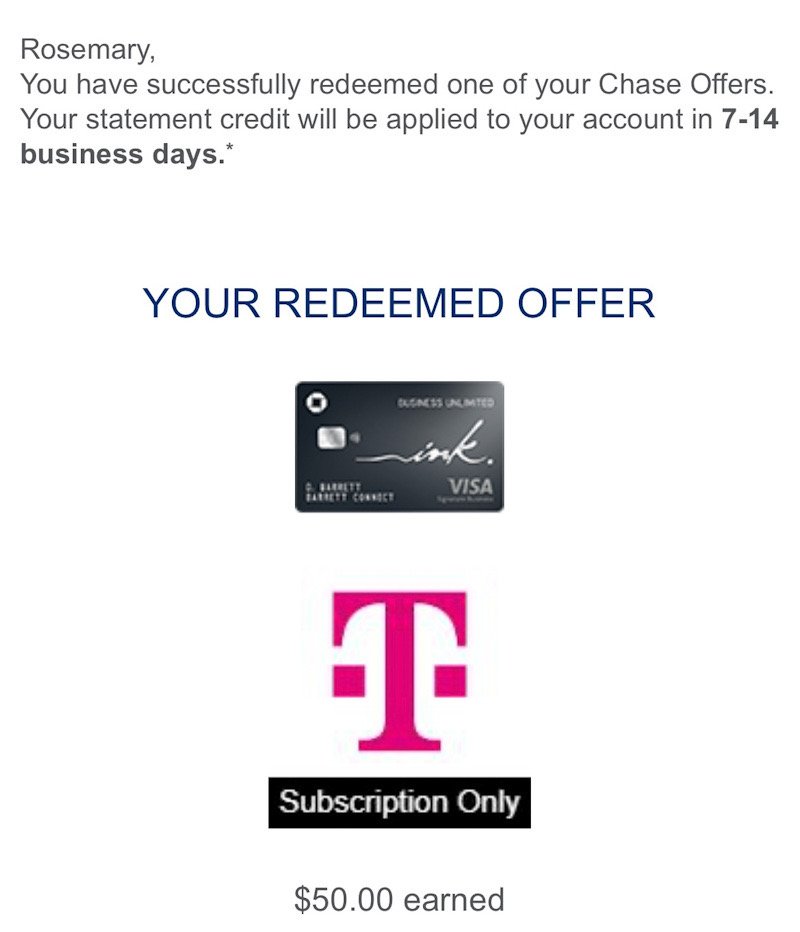

As with AMEX Offers, you will receive an email when you receive a statement credit / successfully redeemed a Chase Offer

My Personal Experience/Savings with Chase Offers

The dollar amount of Chase Offers has historically been lower (and significantly) than AMEX offers but see below for current Chase offers as things may be changing (at least for Chase Sapphire Reserve card holders!) But that doesn’t mean that there haven’t been some great worthwhile opportunities for me!

- $500 Savings/50% savings: I have been waiting (unfortunately for naught so far this year) for the Chase T-Mobile offer to appear again but this was one really showcased how great these offers can be. I was able to add this offer to all 10 (YES TEN!) of the credit cards that had this offer (unfortunately not all of them had it) and paid 2x$50 towards my T-Mobile bill and had $50 credited back! Most of these offers were also on no annual fee cards so Chase literally paid me to have these cards.

- $100 Savings/50% savings: Resort Pass is a great way to have a staycation and also have pool/spa days whilst traveling – wanna learn more? Use my referral code to get $20 off your first booking – note that the offer is eligible only for first time ResortPass users (note that if you had a credit card offer, you can stack both!)

- $45.83 Savings/100% savings: Calm – a meditation and sleep app (if you have been curious about trying Calm, here’s a 30 day limited time guest pass from me!

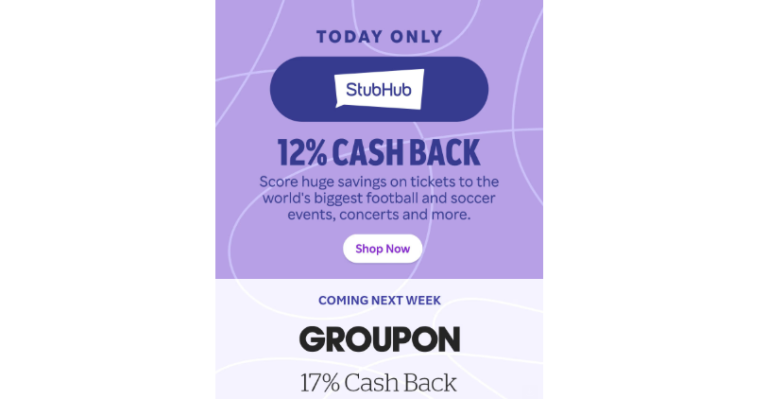

Current Chase Offers

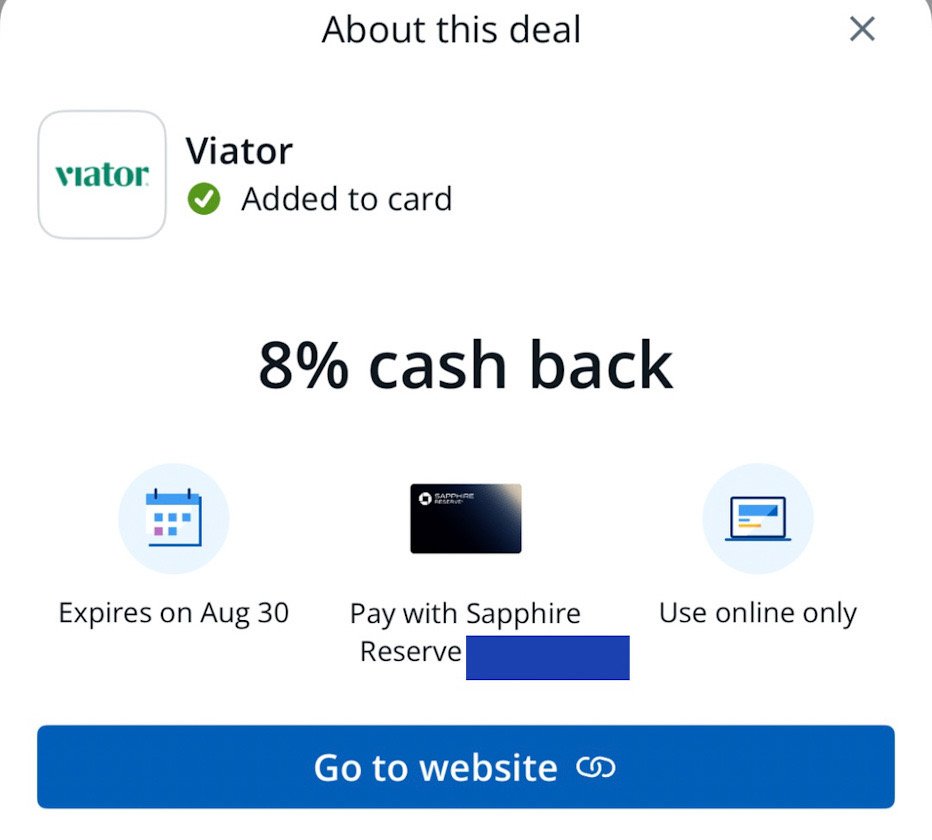

- Viator – lol you should not be surprised by this one at ALL, as very well know how much I love Viator and if you don’t read about why here.

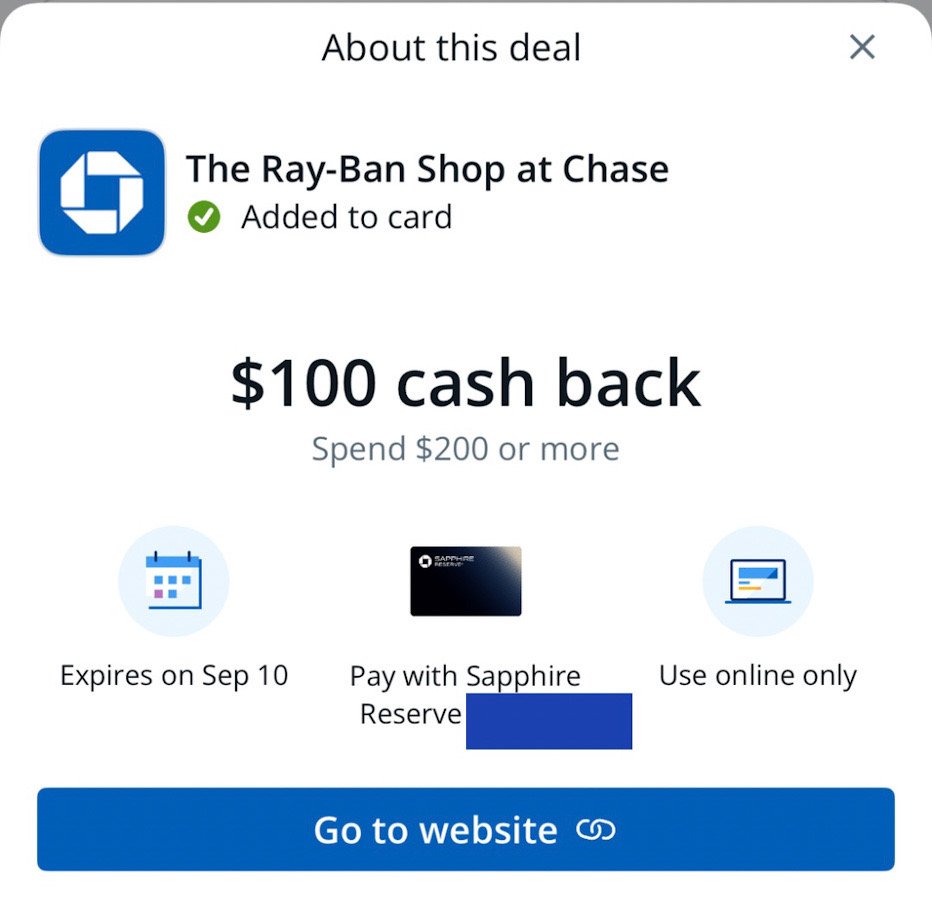

- The offers have definitely improved if you have a Chase Sapphire Reserve – this is a better offer than I had on my AMEX when I bought my sunglasses =/. While annoying that you have to shop through the Shops at Chase, from my quick glance around the pricing is the same as you would find on the RayBan site.

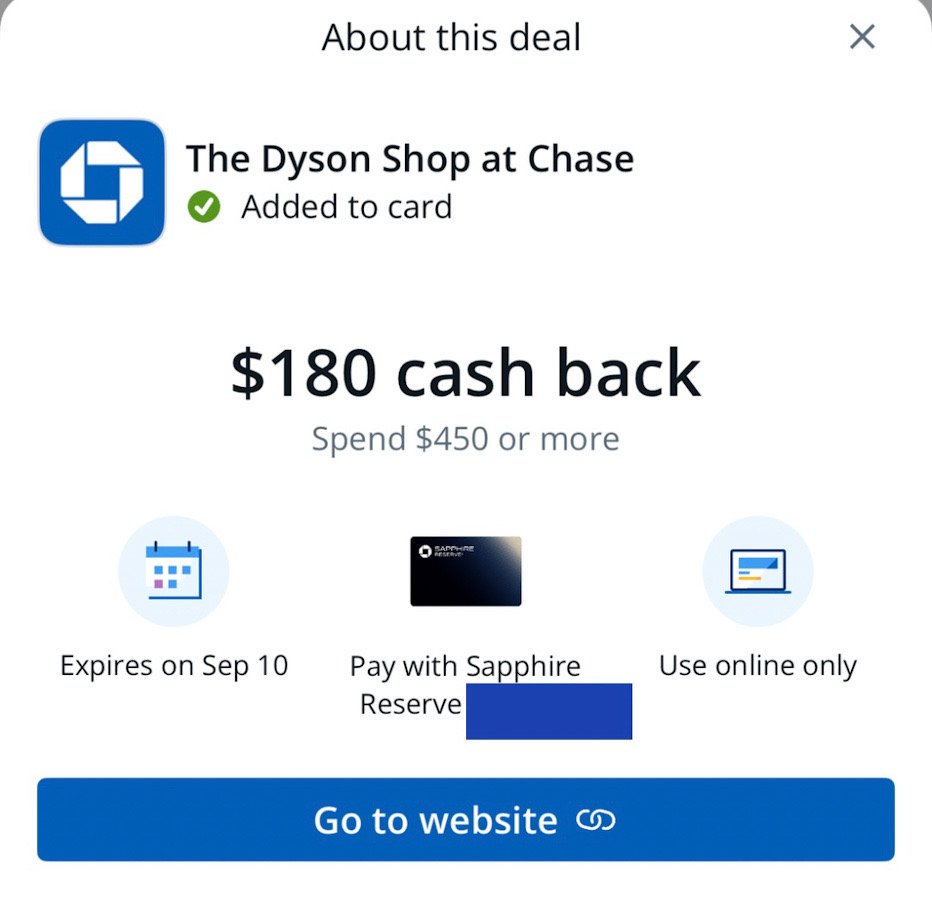

- If you are looking for a Dyson (vacuum or Airwrap) and have a Chase Sapphire Reserve, check your offers as this works out to a massive 40% off!

Beautiful tip: Maximize your money even more by stacking with shopping portals (Rakuten / AA Shopping, etc)

when possible but unfortunately Chase Shops negates this potential additional $ or points/miles =(

Why Should You Do This?

Always look out for ways to maximize your spend – are a few minutes worth $50, $400 or more for you?

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

Damn that’s insane about the number of cards you have for that tmobile offer. How much do you pay yearly

I have been absent for a while, but now I remember why I used to love this website. Thank you, I’ll try and check back more often. How frequently you update your website?