TRIP REPORT: The Secret To How I Spent $600 For My Posh Los Cabos Mexican Holiday Worth $13,500!

Yes you read that correctly that I saved almost $13K on a vacation – how?! Travel hacking. Playing the Game. Making your money work for you. Award Travel. Whatever you want to call it, it is how I was able to spend less than $600 when I visited Los Cabos, Mexico for a pretty epic 5 day vacation.

Travel hacking is simply the ability to travel for cheaper, better, more often and/or (now as importantly for me) with added flexibility.

Making my money work harder involves a combination of credit cards (including sign up bonuses but also leveraging all my credit cards benefits to offset annual fees), loyalty programs, double/triple/double stacking to maximize spending, and using the concept of high/low applied to travel. Akin to what you do with fashion in mixing of designer and affordable pieces when dressing, here it’s some splurges balanced with finding other ways/places to save.

Remember that this is ultimately customizable and that you need to find what works for you! Whether you fly economy or first class, stay in luxury hotels or hostels, or head to Disney every year, you do you. Please don’t ever let comparison be the thief of joy because if you’re able to get one part or almost all of your vacation for free, then you are doing this right.

I am just peeling back the curtain and literally providing receipts as I show you exactly what I have spent in cash, points, miles and where my savings have come from. I want to show you how these trips can be replicated with the caveat that there are a few ymmv. “Your mileage may vary” is an important concept to grasp in travel hacking meaning that our experiences often won’t align exactly (ie things like upgrades like the one I scored during this trip can’t and shouldn’t be expected) but the fundamentals such as free flights and hotel stays are what that you would be able to get by booking with points and miles.

Lastly, I used a variety of these concepts on this holiday so this may seem very overwhelming as there are a lot of things going on here. I am sharing my thought processes to help you understand things and dive deeper into this (if you want and/or are interested). Pick and choose what works for you – seriously, don’t try to replicate all or even most of this if it’s too much for you – now or ever. Remember that I have been doing this for a loooooong time so this comes as second nature for me plus I think about this stuff way too much!

Looking to see how my trip went day to day? Here’s how I spent my time in San José del Cabo and how I spent my time in Cabo San Lucas

- book activities via GetYourGuide(GYG) or Viator & day/spa/pool passes with ResortPass

- combine that with using a shopping portal to earn cashback or miles

- Stay connected/informed with T-Mobile or Airalo

- Read this for info on GYG and this for why I use Viator and this for more on ResortPass

- Details on using Rakuten for cashback and here’s for AA eShopping

- Here’s why I love T-Mobile & the deets on using Airalo

Want to learn more about travel hacking? Read my how to/into to award travel. Need a refresher on credit cards? Check out this post that also covers basics and myths around credit.

TRIP OVERVIEW

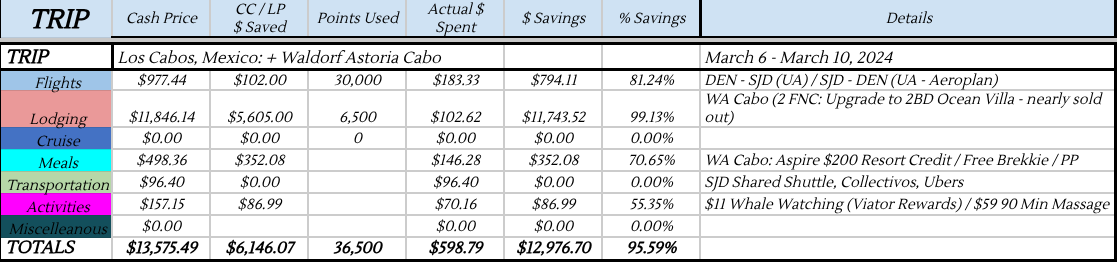

Cost (cash and points) breakdown for the trip - because I love spreadsheets, numbers and data (ha! there are so many more spreadsheets and they are much, much more involved!)Some reminders about how this is organized and where some of the numbers come from. Cash price is what the going rate was when I booked XX (ie: flights, hotel, etc). Take those numbers with a grain of salt because when it includes things like premium cabin flights or even the hotel, these are not things I would be choosing IF I had to pay cash. But they are included because they give you an idea of what travel hacking looks like in action.

Each category/section lists a total spend and then further is broken down as applicable ie what points/miles were used and how much actual cash I spent. There is also information about where the savings came from but note that these are savings beyond the cash price or value of the flights/hotels ie these numbers come from what an upgrade is worth or if I was able to use a credit card benefit to recoup costs. Detailed posts with more information will be linked as they are written (ie itinerary / flights + hotel reviews)

When deciding where to go, I normally either let flights or accommodations guide me since everywhere is on my list. Why one of those categories? Because they tend to be the biggest expenses on a holiday. I had two Hilton free nights certificates that needed to be used (remember that they expire one year after issuance) and perfectly timed my search with the Waldorf Astoria (WA) property in Cabo opening up March availability!

So that’s the spark: budget was loosely set to $1,000.00 for a three day trip, so next step is to see if award flights and dates of hotel nights availability match up!

FLIGHTS

I only had two weekends in March free to travel and surprisingly was able to find awards flights for both. But there was only availability for one of the weekends at the Waldorf so with that, I had dates locked in. Well sort of. I was planning for a long weekend, 3 or 4 day, type trip, flying in on Thursday/Friday and flying out on Sunday/Monday but the DEN-SJD award flights were astronomical for flying in on Thursday + Friday so I pivoted and decided to have a longer 5 day holiday.

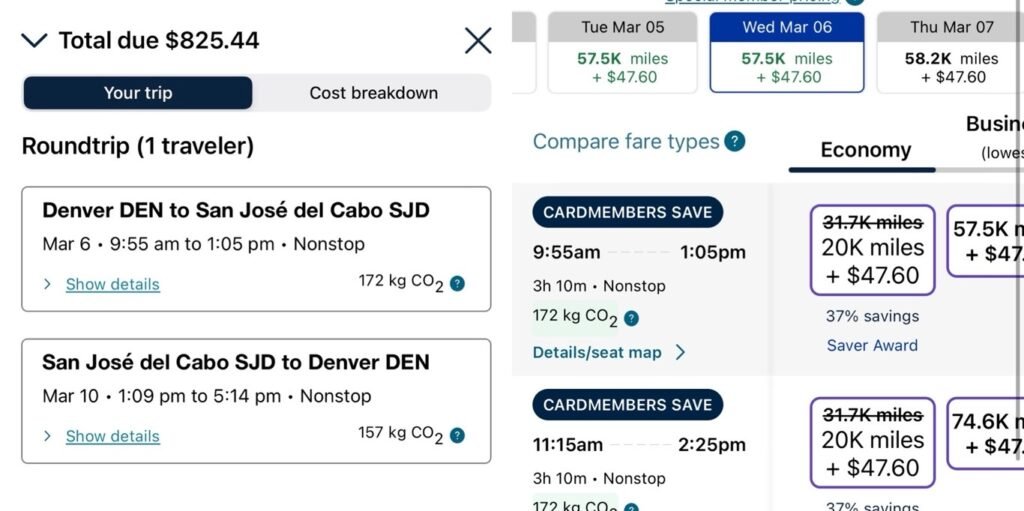

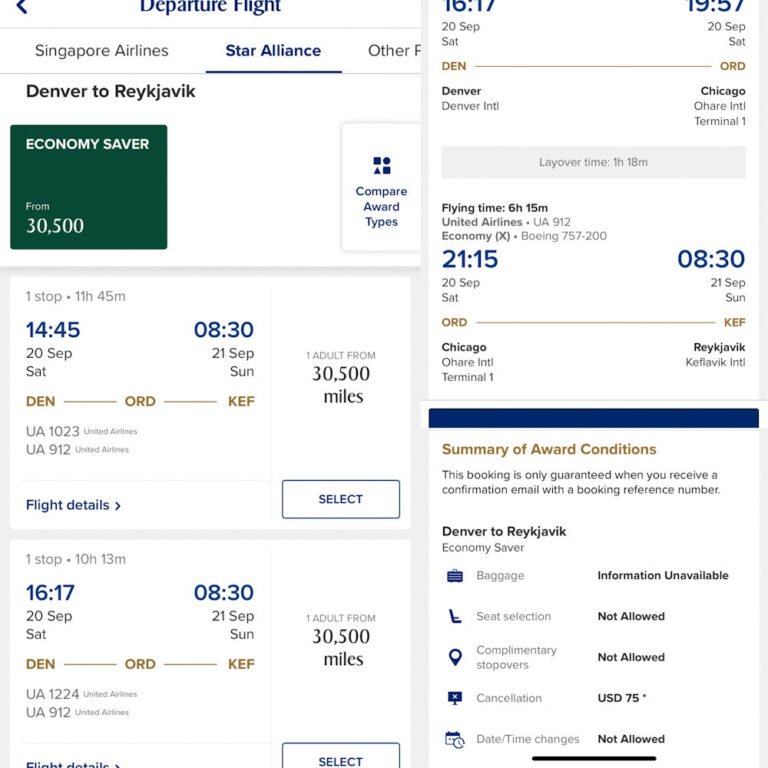

Total Spend: 20,000 UA Miles & $47.60 + 10,000 AC Miles & $135.73 / CASH VALUE: $825.94 / & Additional points savings: 37% with UA cardmembers saving + Using just 8,333 Chase Ultimate Reward points transfer to Air CanadaAdditional cash savings from Economy Plus Seat + Priority Access Fees Waived + Inflight WiFi waived with T-Mobile plan + $50 Amex Aspire Quarterly Credit Card Benefit

If I had paid cash for these flights, it would have cost me $825.44 which would have been nearly my entire vacation budget. Pricing was so high since it’s high season for Cabo (spring break) + only looking at nonstop flights (knee takes precedence even over saving $) + I was looking about 3.5 weeks out from the start of my trip. I was able to save 37% in miles with the discounted save

You will hear me talk about the need for flexible points/currency such as Chase Ultimate Rewards (UR) and this illustrates why. Most airlines are part of global alliances and one of the peculiarities of travel hacking is that you can often find the same flight on a partner airline for less points!

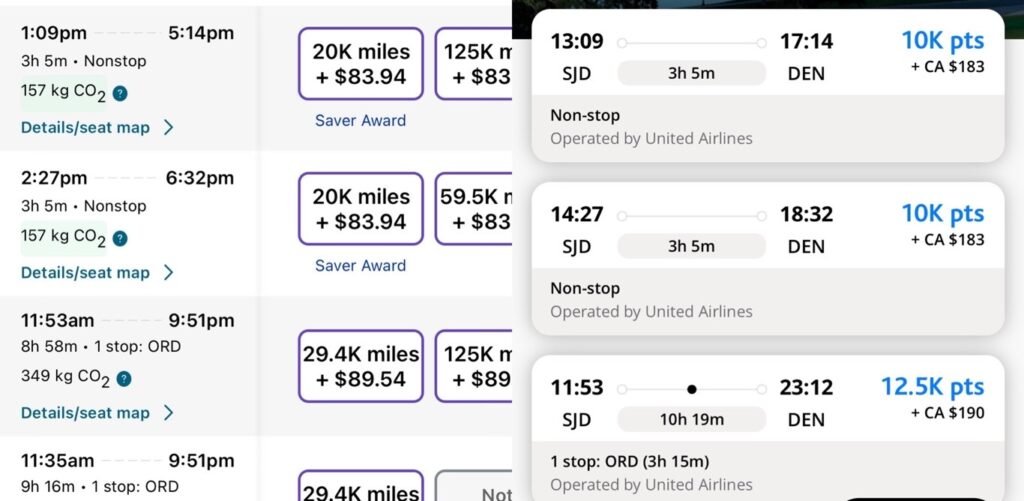

Let’s first delve into flexible points and why they are so valuable. Instead of putting spend on a United card that only earns United miles, I earn UR with a Chase credit card that allows for transfer partners. IRL this means that I can use less points booking the same United flight that would cost 20K miles (bottom left photo) but booking through Air Canada will only cost 10K miles + even better is that technically it was only 8,333 UR points since these were transferred when there was a 20% transfer bonus!

Few things to note here: One bonus of booking with United is that they allow cancellations without penalties vs $150CAD fee that you would have to pay with Air Canada. In addition, UA awards only assess taxes while Air Canada does charge a partner booking fee which is why the amount of taxes/fess is higher with them but still worth it .

Lastly, note as you run searches that partners don’t always get availability to others’ flights (ie ya know how sometimes you only share certain things with some friends and not others – it’s like that). Additionally, with United, it needs to be a saver award (that is available to all ie not a cardmember saver award fare) for it to show up with Star Alliance Partners and be the lowest points/award flights.

I hesitated whether to share this or not but figured this post is all about finding out what works for you….and this is one way to figure out if this is a good time to use points or not.

- Cents per points (CPP) is one way to look at paying cash vs using points. It’s calculated by taking the value minus what you actually paid divided by the number of points/miles used. For my flights it is [$825.44 -($47.60+135.73)]/30000 x 100 = 2.14 or 2.26 if we use the actual UA miles + UR points used of 28,333

- Caveat: CPP is something that I am hesitant to talk about too in depth as I think that it has been blown out of proportion in many travel spheres. For business/first class tickets or even expensive hotels, often these are prices that you would not have paid so the numbers are grossly inflated and not too meaningful. But as a numbers geek, I always calculate and have a personal benchmark that I typically try to hit.

- So let me showcase how travel hacking should be personalized and you do what is best for you as I give you the reasoning for what works best for me. Now with all of my casino comp trips on the horizon and still in the midst of many medical appointments/treatments, I have way more points/miles to burn than cash so CPP is even less important to me. And even on this trip, I will use points when others might say that I should have paid cash instead as they would argue that they can be better redemptions….I share all of this to showcase why figuring out your why and what you want to get from travel hacking to figure out what the best course is for you! Remember travel for cheaper, better and/or more often is the bar set and you get to define what that looks like!

How to earn the points

HOTELS

This is the start of high/low or where splurges/savings come into play for me. Once I saw that it made more sense to have it be a four night, five day trip with how award flights were pricing out, I needed to figure out lodging details. One possibility is that I could have booked the other two nights at the WA, but there were many upcoming comp cruises so I wanted to save my Hilton points. And I also wanted a mixed vacation not just a stay at the resort since this was my first proper vacation since blowing out my knee (and COVID before that!) so I started looking at Hyatt properties. Why Hyatt? Because there is still a published award chart and reasonable redemption rates – this also worked out perfectly as I wanted to check out the San Jose and the art festival.

Hyatt Place Los Cabos

Spend: 6.5K World of Hyatt points +150 MXP/$10 (Housekeeping cash tip) / CASH VALUE: $187.12 / Additional Savings: $10 Upgrade to Higher floor room (Upgrade due to Discoverist status - also included in other sections for savings: Complimentary breakfast)

Fairfield by Marriott Los Cabos

Spend: 35K Marriott Free Night Certificate +150 MXP/$10 (Housekeeping and Bell cash tips) / CASH VALUE: $178.16 / Additional Savings: None

While not ideal to add a third hotel for such a short vacation, I realized that I had a free night award that would expire mid March so it made more sense to use it during this trip than try to use it when I was back home. And it ended up working out well once my whale watching tour date was changed! I was barely at the hotel so unable to really report on the property.

Waldorf Astoria Los Cabos Pedegral

Spend: Hilton Free Night Award (x2) +$132.46 (Housekeeping, Bell and Concierge cash tips) / CASH VALUE: $5,856.74 / Additional Savings: $5,605 / Upgrade to 2 Bedroom Ocean View Villa (Upgrade due to Hilton Honors Diamond status - also included in other sections for savings: Complimentary breakfast)

I did base my decision for this holiday on where I would be able to maximize my Hilton Honors Free Night Rewards and this showcases how they are one of the most valuable credit card perks out there (read more about these awards here). YMMV is so important to reiterate here as I truly lucked out with an incredible upgrade – the kitchen was to die for! But all of the standard rooms (which is what is bookable on points/Free Night Reward) have a plunge pool so it’s a really great choice no matter what.

For my review and more info on my stay at the Waldorf Astoria Cabo, read this!

FOOD

Spend: $146.28 / Savings of $352.08 on meals + drinks from a variety of sources. Priority Pass (PP) restaurants (RIP to one of my all time fave credit card perks esp flying out of DEN!) + PP lounges. Free brekkie at all three hotels (Hyatt and Marriott were for all guests / WA was gratis based on Hilton Diamond Status + Amex Hilton Business $60 quarterly credit card benefit + Amex Hilton Aspire $200 bi-annual credit card benefits

What I ate will be covered in more details in the Waldorf Astoria review and my trip overview posts. Note that anything that is added to my Hilton folio is offset by my Amex Hilton (biz and Aspire) credit cards. How this works: my WA folio was $328.21 and I charged $60 to the Hilton business card and Amex automatically gave me a $60 credit and the rest on my Aspire which was offset by the $200 Amex credit on my credit card bill.

Perfect example of high/low here with a couple of meals grabbed from their grocery stores, some street food, trying out tacos/ceviche at multiple restaurant and one very posh (and pricey) meal at El Farallon plus using my credit card benefit with Priority pass lounges and restaurants when flying to keep food costs to a very reasonable level.

TRANSPORTATION

Spend: $96.40 for a Pre-booked shuttle to/from the airport, collectivos, Ubers / No Applicable Savings as my Uber credits are only usable in the US =(

ACTIVITIES

Spend: $70.16 for cash tip on whale watching tour + massage/cash tip / Savings of $86.99

I wasn’t sure how my knee would respond so didn’t pre book an Arch/lover’s beach trip ~ the incident with the dog did unfortunately affect a lot of my trip and that was scraped. But that would have been pretty cheap ~ I saw signs for $12-$25 when I was walking around the marina and talking to a couple of the operators on the way to my whale watching tour

MISCELLANEOUS

Spend: $0 I was gifted a really cool magnet by a couple that I had met at the art festival!

HELPFUL HINTS

Loyalty pays: My Diamond status really came through with an unexpected and very amazing upgrade!

SUMMARY

It seems unbelievable or that there must be some type of magic happening to have trips like this when I am paying so little but this is why I am so transparent about my costs (and anal about recording them) to literally show you the receipts for how I am doing all of this travel!

But that’s the beauty and power of travel hacking….are you starting to believe me now?

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

Whoa – I saw your tiktoks on your hotel upgrade and got the Hilton card!

Thanks for detailing this trip – I want to recreate it!

Hello my friend! I want to say that this post is amazing, nice written and include almost all vital infos. I would like to see more posts like this.