Award Travel / Travel Hacking 101 Intro

Updated December 8, 2025

Originally published February 4, 2025

This is a very condensed version – check out linked posts for more details!

STEP #1: What is travel hacking?

Trav·el hack·ing (noun): strategies and/or techniques adopted to allow one to travel for cheaper, better and/or more often.

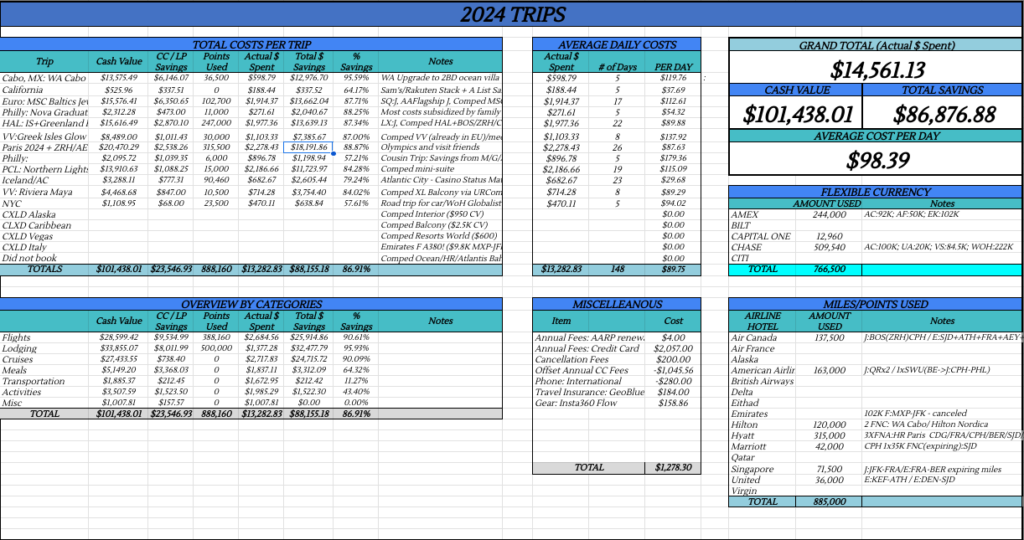

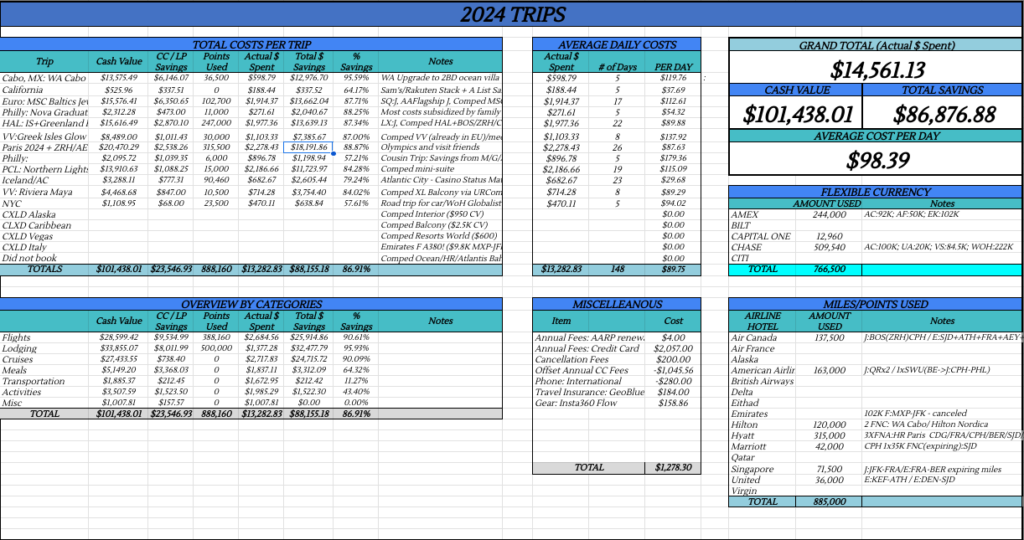

It really is this simple but the rewards can be oh so outsized! Travel hacking is how I was able to fly business class to/from Europe AND stay in some posh hotels AND go to the Olympics AND spend less than $100/day for ALL OF MY TRAVELS – I mean EVERYTHING as seen in my spreadsheet above (want a deeper dive into this – check out the recap on my 2024 travels)

But you are wondering if it’s so simple, why isn’t everyone doing it? Same. But the truth is most don’t know about it AND it can be simple but also can be as complex as you make it.

I think it may be best for us to just dive in and I can explain along the way instead of confusing you (more?) =)

STEP #2: Okay…so how does travel hacking work with award travel?

While I also discuss many other tools and tricks to save money, 80-90% of the time when I am talking about travel hacking, I am referring to points and miles (note I will use either: “points or p/m” onward).

Award travel is using points/miles to book flights or hotels ie instead of paying $2,195.20 for a business class flight, you pay 56,700 miles and $5.60 (if you’re think that’s oddly specific it’s because I am using what I did for the lie-flat Singapore Airlines flight to Europe picture above).

You want to amass as many points as you can and by far, for those of us that aren’t road warriors, the number one way to do this is with credit cards.

This is travel hacking at its finest since it’s doing something in a clever or efficient way and earning miles/points without flying and staying in hotels! It’s crazy right? Yes, and that’s where things seems a bit farfetched but I assure you and can provide lots of evidence about how this is really possible!

STEP #3: Make sure that your financial house is in order

If you need a refresher on credit or just want to learn more including my busting of some big myths around credit: read this

We’ll get to why credit cards are so crucial in a moment BUT I cannot stress this step enough!

It would irresponsible of me not to have this step included because there is NO AMOUNT of rewards that will offset INTEREST (compounding is crazzzzzy – good for saving / bad for interest on credit card) so please do not get credit cards if you are unable to pay them off monthly! I was young and dumb once too and I learned the hard way about interest so none of this comes from a place of judgement. If you have credit card debt, please do not add to it – your time will come but really the math isn’t matching if you pay interest!

Some of the things you will need to know are: what your credit scores are, what your credit history looks like (including cards opened and dates) and also review your spending: important to note what you can spend in a 3 month period and are there any particular times of the year there are spikes? Again there’s my basics and myths on credit, you can check out

STEP #4: Okay so why credit cards?

This is the beauty of travel hacking for me: that you use credit cards to pay for everything you have to spend money on anyways (IMPORTANT to note that you aren’t spending any more than before!) and are rewarded handsomely?

HOW?! Because of sign up bonuses (SUB) – this is the big number of points that card issuers will give you for opening up a new credit card. For a lot of people, there is no other way for many people to gain as many points/miles quickly than getting credit cards with SUBS.

Spending $10,000 by opening two credit cards (and accompanying SUBs) could net you 163,000 points (which could be eight nights at this Paris hotel) which is worth more than the $150-$200 you could earn on a no annual fee credit card earning 1.5-2x cash back or 10,000 points on the United card you have had for year if you already had one of those cards and put the $10K spend on either.

So there are probably two camps firmly established now: those that will have no problem with meeting the minimum spend requirements (MSR) for SUB and those that don’t have a lot of spend. One of the stipulations to get the SUB (aka how the bank likes to know if you’ll likely be profitable for them) is that you have to spend $X in a certain amount of time – with the lower ends being $3-4,000 in 3 months.

So if you are in the latter camp, this is why I wanted you to assess your spending earlier. I will give myself as an example: I plan for new credit cards around when I pay property taxes or for my annual car + house insurance premiums as otherwise I wouldn’t be able to meet the MSR (or at least couldn’t before the darn knee thing!). I also put everything I can on my cards including paying for health insurance premiums, all of my medical stuff (silver lining), utilities, dinner out or trips with friends. Note: I do offer individualized coaching in this arena as there are other opportunities that you may not be aware of that we can discuss one-on-one.

STEP #5: Figure out your what/whys

In many ways, I think this is important enough that I should have made this step #2 but decided that the post flows works best to have it here. Anyhoo, this IS HUGE for so many reasons but this goes back to the question if this is so simple why isn’t everyone doing it? It can be simple but I cannot and will not pretend that it is easy – it does take effort but the great news is that the choice is yours for how to proceed.

Questions to ask yourself: WHAT do YOU want to gain from travel hacking and the WHY is secondary as to help refine your answers and desires. Plus it can help shed light on how much effort you will need to put into this if you are working towards a dream months long around the world trip or bougie first class honeymoon that will take considerably more effort than you wanting to have some of your next holiday be free.

Plus I have learned that for most, it’s easiest to have a goal to work towards and make the effort worthwhile if you know what you’re working towards. Also know that your answers can change as your situation and needs change.

STEP #6: Learn about travel reward programs

Explore the programs from the different credit card issuers, hotels and airlines. ESPECIALLY IMPORTANT to find out about any rules you should be aware of! ie Chase and their 5/24 rule.

Lesson: not all points and miles are equal AKA why flexible points are INCREDIBLE

If you are only looking at the number of points in a sign up bonus, then it may seem CRAZY that I will tell you that for many people, the Chase Sapphire card is where you should start – see here for more on why. But if you think that you will really dive into this, then the Capital One Venture might be the right first step AND there is currently an elevated sign up bonus, read this for all the details!

People will ask why I wouldn’t recommend a Hilton card that gives 110,000 – 170,000 points vs the 75,000 that the Sapphire Preferred or Reserve gives and it boils down to steps 6 and 7 – that they are not the same. Trust – I LOVE my AMEX Hilton Aspire card but I also know that Hilton Hotels are typically 30,000 and can go up to 150,000 for high end properties (I know Hilton says that it can be as low as 5000 but I haven’t seen them and they aren’t capped at 95,000 now either). So maybe one night stay but 75,000 can be transferred to Chase partners including Hyatt where I have stayed at many hotels for 5K/night and even had a few off peak stays at 3500/night or to Virgin where 29K miles can get you business class seats across the pond!

STEP #7: Set up a plan (ofc logistics!) and look at the big picture

One of the big issues that I have people coming to me with is that they jumped in wildly to this travel hacking hobby (lol what many of us affectionately call the game!) and that they are unable to open accounts with XX now. They missed step 6 and the crucial part about rules and trust me kids, they matter.

There can be valid reasons to get a credit card but there may be more compelling reasons to get XX card before and look at the full picture before getting what is a “too good to be true offer”. Many people make the mistake of trying to make up for lost time especially if they have high spend which is understandable but sometimes you need to take a step back (it’s a question of can you do it before it’s being told to take a step back?)

One of the other important aspects is to stay organized: how will you keep track of spending and deadlines for SUBs?

MONITOR/REVIEW ACCOUNTS

It is really important to safeguard your information. Some biggies: DO NOT REUSE PASSWORDS people!-while we have unfortunately seen that they are not fail safe, you should be using a password manager and please do not reuse a password for this.

Regularly review your accounts (credit bureaus/credit card /bank/loyalty programs) with emphasis on two areas: to ensure that things look okay (there’s nothing unusual going on and miles/points have posted correctly) and expiry dates. Two ways to do this with trade-off to each approach: manually yourself (time) or using an app/program (security)

Once you have set yourself for success with a plan for the above items, it is time to start learning more so move on to the next items. Also check out my 8 Top Travel Hacking Tips for more depth to this intro!

STEP #8: This is really only the beginning

Before you get intimidated and quit (especially if you have peeked and have been overwhelmed by my past travels), please don’t and remember that I have been doing this a LONG time as in DECADES now and I am also really obsessive about it. And as I am fond of telling people – as with life, there are levels to this! You master the basics and then continue to move on – and you decide where and what you want to learn!

Want to see how this works IRL? I write up two types of master posts for my trips: the overviews have the itinerary with links to activities/excursions, hotel/cruise/airline reviews, etc and the trip reports deep dive into the travel hacking aspect ie what I spent (cash, miles, points) and what I saved (and how) PLUS I will share on individual posts any and all relevant travel hacking insight.

AWARD REDEMPTIONS

Hotel redemptions are definitely easier to master and have loads of value.

Know that practice makes perfect – really there is no substitute for performing award searches to understand how to do them and get better at them.

DIVERSIFICATION

If you haven’t noticed, I am sorta a finance nerd so of course, I have this here. But as with all assets, having multiple pools of points and miles along multiple card issuers, airlines and hotels is the way to set yourself up for success.

MAXIMIZING LOYALTY PROGRAMS

Discovering sweet spots for redemptions – AKA when there’s an especially sweet deal along with getting good at award searches will help you really maximize your points!

But this area can also include elite status. I know that in many of the travel groups, people talk down on elite status not being worthy of something to work towards/get. But I have personally benefited from having it not just for upgrades but more so for when things go wrong or I need help- that type of available and senior help is priceless imo. Plus if you haven’t figured it out, I am obsessive about travel hacking and it included getting elite status =)

MAKE YOUR MONEY WORK FOR YOU

This is why I love credit cards but also travel and money hacking in general because I get to put this principle into action. And there are so many other things that you can do here – all of these in action is how I keep my travel expenses so low! This is the stack on to earn more points+miles and/or saving more cash!

TRAIN YOURSELF TO MAKE DECISIONS + ACT QUICKLY

My last piece of advice may be the most important: remember that things are EVER changing in travel hacking and as I counseled many not to do last year: is do NOT hesitate to take action. One big example is with the casino status matching jackpot – there were quite a number of people that kept wanting to wait for x,y reasons and unfortunately became so popular that the travel hacking in for matching was eliminated.

This cannot be stressed enough especially as you begin searching for award redemptions – they are of a limited quantity and will likely be snatched up if you sit too long on a decision. IF you have been practicing award searches – you will begin to see when it is a great deal and/or as importantly, if a redemption is ideal for your travel needs.

And one last note about using your points: one reason not to sit on points/miles is that they do lose value over time. Loyalty programs will continue to make changes as more and more people get into travel hacking. It cracks me up when people bemoan this in travel forums (esp the newbies) perhaps I am not as jaded because this is really just econ 101 in action AKA inflation at work. Reward flights/hotel redemptions are the goods being sought and are of a scarce quantity but as more people with more means to get them (points/miles) continues to rise, the value of the goods will also go up.

So perhaps it is best that everybody does this….but if you’re here – welcome and join the fun!

Wanting to dive even deeper? Check out my top 8 tips for travel hacking – read it here

About Author

Rosemary is a travel hacker, points nerd and female solo traveler who’s explored 70+ countries without a trust fund, sugar daddy, or sponsored content. Every mile, upgrade, and trip is completely self-funded using a mix of points, miles, and cash or earned with elite status. And she shows you the receipts along with a mildly concerning amount of spreadsheets. Through firsthand experience and plenty of trial and error, she teaches everyday travelers the art of travel hacking and how they too can travel for cheaper, better, and more often. While Rosemary doesn’t take herself too seriously, she does take award travel (and searching for the best ice cream) seriously – because seeing the world shouldn’t be reserved for the rich, the retired, or content creators with brand deals.

An interesting discussion, it might not be a taboo subject but generally people do not speak on how they get their free travels besides follow me and become an influencer and travel free. Cheers

A great way to learn about all of this – thank you for posting.

I cannot find your e-mail subscription link or e-newsletter service. Do you have any? Please let me understand so that I may subscribe. Thanks.

Thanks for all your efforts that you have put in this. very interesting info .

Fantastic blog! Do you have any suggestions for aspiring writers? I’m planning to start my own blog soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m completely confused .. Any recommendations? Bless you!

I have learnt about some good stuff here. Definitely worth bookmarking for revisiting. I am impressed with how much effort you have put to create such a magnificent informative site.

I am so happy to read this. This is the kind of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this greatest doc.

You could certainly see your enthusiasm in the work you write. The world hopes for more passionate writers like you who aren’t afraid to say how they believe. Always follow your heart.

Saved as a favorite, I really like your blog!

Have you ever considered creating an ebook or guest authoring on other sites? I have a blog based upon on the same topics you discuss and would love to have you share some stories/information. I know my visitors would enjoy your work. If you are even remotely interested, feel free to send me an e mail.

Appreciate the insight

You really make it appear really easy with how you talk about this but I am finding this topic to be really something which I am not understanding. It sort of feels too complex and very large for me. I am having a look at your other stuff to try to get the grasp of it!

Hi Alice! Don’t be too hard on yourself, this is tough to wrap your head around. Take baby steps and approach this with as much time and effort as you can.