Life, Love, the Pursuit of Travel & Points x 2 Million…and Counting

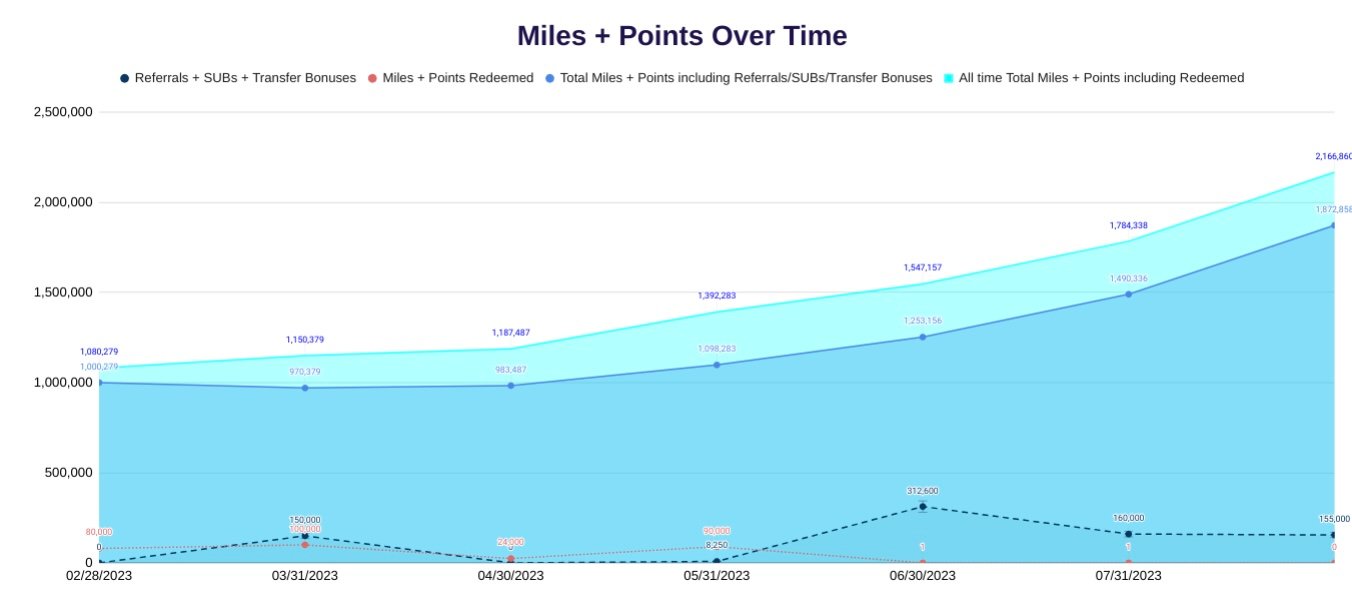

Since mid-March, I have amassed just under 1.1 million miles and points and I will show you how in five months, I doubled my points total! (For simplicity sake, I will refer to all miles and points earned as points from here on out.) While this is admittedly an extremely amped up example, it also is a real life application of the fundamentals explained in my primer on travel hacking. There was a lot covered in that post (and some applied financial concepts that may not be familiar to many), so I am going to mirror that post as applicable and show how I put those ideas into action to earn so many points.

Table of Contents

- #1- Figure out your “WHAT(s)/WHY(s)”

- #2- Accept (and then learn to MINIMIZE) Credit Card Annual Fees

- #3- Embrace that credit cards and large sign up bonuses (SUBs) are how you quickly build up a lot of points

- #4- Understanding that not all points and miles are created equally

- #5- Sign Up for and (then learn to MAXIMIZE) Airline and Hotel’s Loyalty Programs (LP)

- #6- Realizing that this hobby takes effort, practice and time

- #7- Flexibility is key and be prepared to act quickly!

- #8- Learning the formula CPP (cost per point) BUT also take it with a grain (or really a pound) of salt

- Last tip: Remember you don’t have to know it all, you just have to know where to look (aka lean on resources!)

1. Find your whats and whys – AKA what do I want from this to make the extra work worth it?

A necessary first step for the simplest reason that it helps you get started. But as importantly, sometimes you will need to be reminded of the why to give motivation to keep going. A couple of years ago, my parents decided that they wanted to mark their milestone anniversary by going on a big family cruise. I thought I was just helping book the cruise at first but then I (begrudgingly) became the planner and coordinator for this trip. As many know, I have been dealing with a very complicated and long recovery/rehab for my knee and am still in the midst of that. Since January 2021, this is something that was already taking up almost all of my energy, money, and lots of time and now, I had to add in figuring out the logistics of a long Northern European cruise for fifteen people. My whats/whys were multi-fold: 1- this was to celebrate my parents’ fiftieth anniversary, 2- we would probably never take a trip like this again, 3- whatever I could plan ahead for would make it less stressful once there + would likely save us money and 4- POINTS. When things or people would become overwhelming, I would silently repeat to myself: remember it’s for reasons #1,2,3 but I found ALL the POINTS to be especially motivating. And haha yes, I do give myself pep talks like this IRL – who doesn’t find the phrase: it’s for 1 million points to be comforting?

2. I love credit cards in that they make my money work for me plus I look for BIG sign up bonuses – this is the foundation of travel hacking!

Caveat: please only consider if you pay off the credit card IN FULL every month because no reward amount can justify interest charges as the interest amount you pay will always exceed any rewards you earn! If you are new to credit or need a refresher, here’s a primer.

I don’t typically have a lot of monthly spend so I always take advantage of those times when I have big bills to pay (typically annual property taxes and yearly car/home insurance premiums) to get more points through a sign up bonus (SUBs). Singlehandedly, that is the quickest way to earn lots of points and this trip was presenting me with a gold opportunity with the hotels, transportation, and excursions costs. It was pretty great in that I would cover (some of the) costs and then be reimbursed by everyone. BTW, this is also when your whats/whys will be handy – for many, a pain point is opening cards and having to switch out spending to the new card. I have been doing this for almost two decades so it’s second nature for me to have to switch out cards for spending. My long term what is: to see/experience as much of the world as I can and I have lots of first hand experience in knowing just how valuable those points are. Develop a system to make it easier for yourself – I put all spend on my new card and I charge absolutely everything I can. Remember that it’s short term pain for long term gain (ie I would not be at 55+ countries if I haven’t been using points!)

So back to our cruise now and this is when the scenarios and numbers get pretty crazy, so use this more as a reminder to maximize your spend and/or to capitalize on opportunities, than a ‘how to guide’ as YMMV. Your mileage may vary AKA your experience will likely be VERY different, especially since I ended up opening 8 new credit cards in a little over three months. Since I was paying for so much and normally don’t have anywhere near this spend, I wanted to push the envelope a bit. For those curious, I won’t go into what the the individual cards are but I will list out the issuers of the cards and (date approved): AMEX (3/16/23), Capital One (3/17), Chase (4/16), AMEX (5/12), Barclays (6/6), Chase (6/8), Citibank (6/22) and AMEX (6/23) with a mix of personal and business cards. I still have never been denied for a card; and all but one was instantly approved (and even that one was approved the same day) and my credit score continues to be over 800. Please note that this is a very high rate of opening accounts and most (including myself) would recommend going a lot slower with the reality is that you need to stay in the good graces of these banks. I felt confident in how strong my credit profile/low my risk profile was plus have had long standing accounts with Amex, Chase and Capital One – enough so to push it with the four cards in just over two weeks.

TOTAL EARNED FROM CREDIT CARDS: 761K = SUBS: 685K – I have met the SUB on 7 of the cards + SPEND: 86K – Note $86,000 was NOT charged as many if not most spend earned more than 1 point/$1

8. Resources/Help: I am referencing this point now because I was only really able to capitalize on the next items by learning these other ways to maximize points. I have been doing this a long time and there is still so much to learn – and the great part is there are now so many more resources to help one on their points journey. I know that I pushed the boundaries on opening credit cards a bit more than I would have due to one of the FB groups I was in – a bit of FOMO on the extra points on SUBs. I suppose I was also curious at what point I would be declined or go into a long review but I was also confident that credit history and strong profile would suffice. I earned an extra 300K+ points because of those extra credit cards and their SUBs I might not have opened otherwise.

3. CBA: How to figure out (the analysis) when spending money (the costs) is worth what I am getting (the benefits)

Annual fees (AF) are part of the game (another way I refer to travel hacking) and an example of when you have to spend money to earn money. I talk about this in the travel hacking primer and want to expand on that point with how there are so many ways that you can utilize the benefits of the cards to negate the AF. Take my Ritz-Carlton card that gives access to Priority Pass (PP) restaurants among many other benes. This card is especially nice since my AU (authorized users whose cards carry a $0 AF!) also get access and at DIA, there are two PP restaurants. With three PP cards, we were able to apply up to $168 to a bill at Mercantile, and only ended up spending $25 which was the tip on our yummy $120 breakfast!

Specifically for this time period, I think of the AFs that I paid for allowing me to earn 685K points that I wouldn’t have otherwise – absolutely worth it and that is before taking into account some of the very lucrative benefits on the cards. But there are also some deals to be had – two of the new cards have no AF and one is waived for the first year, so as always, doing the research pays off.

4. Understanding that not all points and miles are created equally:

I think it’s obvious that I am a bit of a nerd in general especially since I geek out on economic ideas and apply them a lot in this hobby. Partly it’s how my brain works to justify costs but they also help to explain ideas and trends so well. Once you start going deeper into travel hacking, you’ll see that there are some “sweet spots” AKA really good redemptions with American Airlines. So this is where economics comes into play – while it is great, wonderful even, that so many people are now in the points game and many spaces are showing people how to do it, a basic economic principle now comes into play. Inflation (or what many in the points sphere refers to as devaluation) is simply when there are too few goods being chased by too many people with too much money. In the travel hacking world, this explains how award flights/hotel stays (already a limited commodity) got more expensive because too many people with too many points are now playing the game. But American Airlines, only has a smaller transfer partner (Bilt), so those two second conditions don’t exist to the same degree that you see with airlines that have AMEX, Capital One, Chase and Citibank as transfer partners. Simply, there are less people with less AA points out there for those AA flights (or partner Qatar flights) vs lots of people with so many Chase UR points trying to get those same Qatar flights using Avios! This is one of the reasons why I decided to focus on accumulating AA points through the shopping portal but the other is that I would be able to earn status and that was as big of a reason.

Reminder that you also shouldn’t ignore points or leave any on the table. So even if a Hilton point isn’t worth as much as an AA or UR point, if you stay at a Hilton, sign up for the loyalty program. I have Hilton Diamond status (actually granted by one of my credit cards) and that helped me max how many HH points I earned with Hilton stays. Complete win as I was able to find a hotel with a fantastic central London location, that had a really great complimentary breakfast, that was in easy walking distance to the Waterloo train station and now will help set up one of my next vacation with the points earned! In Iceland, status was very valuable as it granted me club lounge access (great to save money anywhere but even better in expensive Iceland!) and a much needed late checkout after my morning Silfra snorkeling expedition.

Another wonderful resource that I learned about was wheretocredit.com which can help you figure out which airline you can earn points from a flight. Case in point, I learned that my Icelandair flight home could earn Alaska miles and this was even on the discounted cruise fare! This is a prime example of understanding point values: I would have earned more points with Icelandair but those points aren’t useful to me especially compared to very valuable Alaska miles.

TOTAL EARNED FROM HOTEL STAYS AND FLIGHTS: 89K

5. Applying the formula CPP (cost per point)

Normally when you think of CPP, you are calculating a value for the points you are using for a hotel stay or flight. But every once in awhile, you may be presented with a choice as to whether it would make sense to PAY for points. For me, it was with Rocketmiles and the London Hilton. First, it’s important to know the rules for loyalty programs such as Hilton only allows you to earn points on a max of 4 rooms/night. This meant that I would have one hotel room that was earning ZERO points on the stay. So this is one of those times that it made sense to consider another way to book for THIS room. (Quick tangent that this shows how quickly things can change with this game, this particular hack became obsolete or not nearly as valuable during my trip!) Rocketmiles hotel stays were a favorite way for certain AA enthusiasts to rack up points and in this scenario, would offer me a way to earn 3K points but the room was more expensive through RM. The calculus that I would have to make was would I be willing to pay $25 extra for those points (this was not something that I passed on to my family since it was a purely me charge) and I didn’t even have to plug it into a formula. This was the only instance that I paid extra for more points but it was $50 to earn 6K AA points on a room that would have otherwise earned zero points. Another way this is unusual is that I normally NEVER use an OTA/third party to book for a lot of reasons but esp since if something went wrong, it can become difficult to resolve as you have to go back to the OTA instead of dealing directly with the hotel/airline. But the concierge had reached out to me once I booked so I made sure that this RM booking had been transferred to the hotel and also ask that they attach my HH number. Whilst I wouldn’t earn points, it ensured that they knew it was with the other block of rooms and was for a high status member.

6. + 7. Understanding the concept: ROI (return on investment), flexibility is key and be prepared to act!

ROI is simply a calculation of the monetary value of what was gained versus the costs associated. For me and this trip, ROI comes into play in a couple of ways. First, while I wanted to book tours/excursions on Viator and through a shopping portal to earn points, I needed to see if there would there be any downsides such as paying more or losing flexibility? This is especially important since my family would be bearing those additional costs then as well. Luckily the difference was barely higher (within a dollar or two) from what was advertised on the companies’ websites so it made sense to book through Viator. But this also meant that I didn’t book things that had cheaper alternatives just to earn more points. ie in Akuyeri, I wanted to see Godafoss waterfall and there were taxis for 8 persons that would be ~$330 total vs a tour charging €65/person. This all goes into making your money work for you in the smartest way possible.

The second time that ROI would come up was with my time. I spent a what can only be described as an insanely stupid amount of time researching for this trip to try to make things go smoothly. It’s quite the endeavor to figure out what would be the best for such a diverse crowd + to learn about these ports + NCL + cruising in general. See how a why is important? 1 million points gets whispered as I argue with NCL reps or scour FB NCL groups for info. Lots of wasted time when I would have to weed through lots of complaining to get to the helpful information. So spending an extra five minutes to follow best practices and collecting all relevant info to ensure I can get to a million+ points seemed very reasonable

It was even worth it to rebook a few of the excursions multiple times. The rate went from 8x/$1 to 9x/$1 and then a whopping 12x/$1 which increased my original points by 50%! Part of that was just figuring out ports and the excursions so I would focus on 2-3 places a day and would see multipliers go up. So I was super happy to see a FB post on Viator becoming 12x in the portal and jumped on the opportunity. Booked a lot of possible excursions on that day with a just in case attitude. For those that don’t know: Viator has a book now and pay later option (charged two days before tour) with most excursions being refundable 24 hours prior to the local start time. The 12x multiplier was live for ONE day so I am so glad I didn’t wait and was luckily checking FB before my PT appointment to see a post on this!

*There’s probably some people that are shaking their heads thinking I should have went with the cruise ships’ excursions. NCL was so expensive, we decided we would go with outside companies. After corresponding with them prior to the tours and whilst on the excursions, I have come to understand that many of them deal almost exclusively with cruise clients and have a system in place so it doesn’t happen that the boat leaves without you. And if it does, that they will get you to your next port as they don’t want to ruin their reputation. YMMV of course but it was definitely worth it for us since we spent 60-75% less than we would have booking directly with NCL.

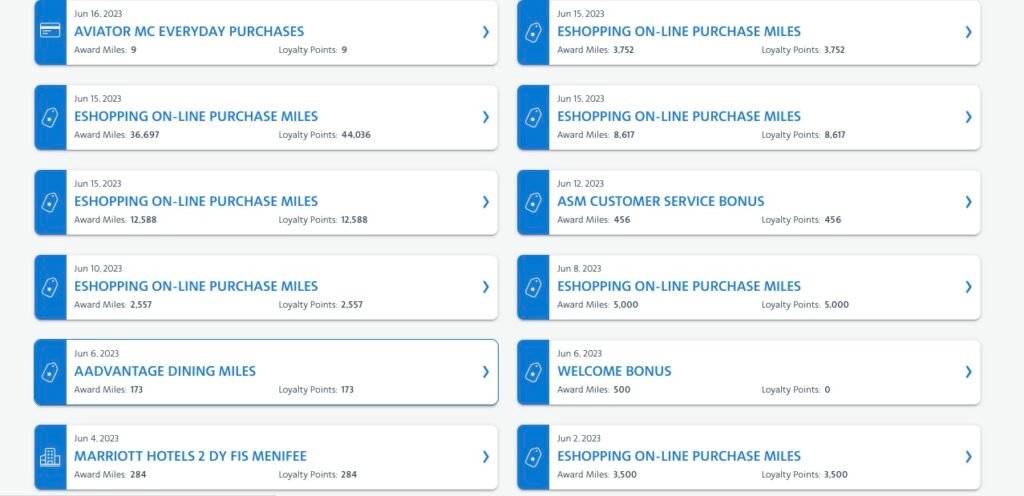

TOTAL EARNED THROUGH AA SHOPPING: 118K

8. Resources/Help

I want to come back to this point since I can’t stress it enough: there is so much information out there that can help you in this game now. I am still learning new things! What became time consuming by the end was keeping track of my points through the shopping portal and then having to fill out multiple inquires to get the last 60k points posted. A lot more work than I would have liked but so worth it in the end. Again using resources is critical and Loyalty Point Hunters (both FB group and website) were invaluable for the guidance and best booking practices. Luckily I like spreadsheets and documentation is now just in my blood from being a manager for so long lol.

Cashback Monitor: A cashback comparison tool for miles, points and cashback – rates can vary dramatically from shopping portals so it’s a good idea to check if you want to get the most bang for your buck. It makes most sense to check right before you make a purchase. Also I learned that Safari (and Firefox) while great for more secure browsing are not ideal for using the portals as cookies are necessary to track your purchases. So I would clear my Chrome browser history and only have this site up and click to the best rate. If you are going to do any comparison shopping, do it beforehand (I would save an excursion as a favorite to Viator once I found one I liked whilst researching). This way I could sign into the chosen portal which would direct me to the vendor and I would sign into Viator and be able to select and book the excursions.

Rakuten: Is the other portal that I use since I can earn Amex MR points. If you haven’t signed up, this is a referral link that will put $30 in your account once you spend $30 in 90 days (I also will receive a bonus!)

PS I should also stress that my SIL did help with booking the first few excursions for things we knew we wanted to do for certain. And she was very open to having me rebook them so I could get the points! Use all your resources. It works out (in this instance haha) that my family wasn’t fighting me for points and even better that I would book everything and be reimbursed. To drive this point home a bit more about seizing opportunities, my total for the excursions was $671.45 & along with putting some of the cruise charges, hotels, transportation, and many extras, I was able to hit multiple SUBs + earn all of these points through multiple avenues + obtain Platinum Pro status with AA that gives me oneworld Emerald status (plus I will status match to United and be UA Platinum)!!

*Lastly I appreciate each person that has used my referral links for various cards recently – as these pushed me over in 1.1 million points territory! Always cool to see how I have become a resource for many!

TOTAL EARNED FROM REFERRALS: 110K

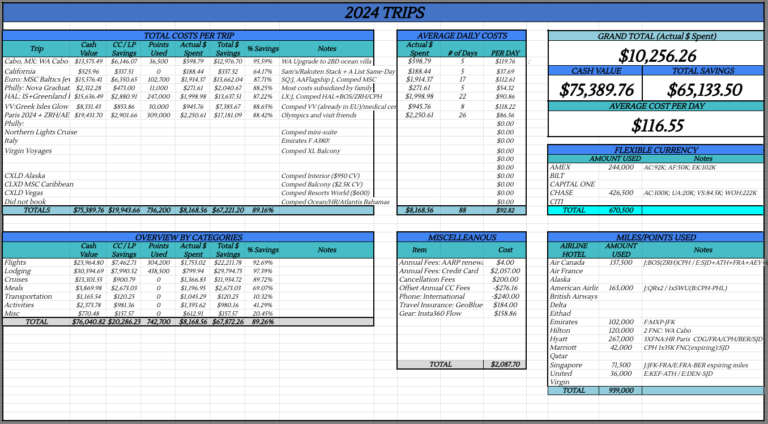

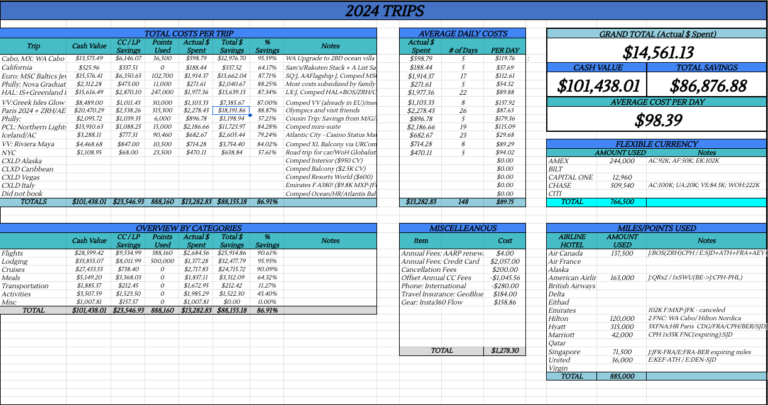

My WHY: is that I want to live life to fullest and for me, travel is a huge part of who I am. My WHAT is simply to travel more and the adage about the best money is spent on experiences holds especially true for me. Yes my hot air balloon rides were expensive but I will always remember those magical sunrises over Bagan, Burma or Cappadocia, Turkey as seen below. Travel hacking had allowed me to use points/miles for flights so that I could spend my cash on experiences like this!

Hopefully this hit home how you can making your money work for you and how to capitalize on opportunities – do you still have questions? Or is there a subject that you wish I had gone more in depth about? Please let me know and I’ll see if I can work it into an upcoming post!

Hopefully this hit home how you can making your money work for you and how to capitalize on opportunities – do you still have questions? Or is there a subject that you wish I had gone more in depth about? Please let me know and I’ll see if I can work it into an upcoming post!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

This design is incredible! You certainly know how to keep a reader amused. Between your wit and your impressive numbers, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Hi there, You’ve done a fantastic job. I certainly dig it and personally will recommend it to my friends. I’m confident they will be benefit from this site.

You are my inspiration!